CATEGORY

Air Freight Services

Air freight delivery is the transfer and shipment of goods via an air carrier, which may be charter or commercial. Such shipments travel out of commercial and passenger aviation gateways to anywhere planes can fly and land.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Air Freight Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Labour actions can cause disruption in Spain, France and the UK

March 21, 2023Air Cargo Rates are Softening

October 20, 2022Air freight rates Ex-Asia declines due to the fall in demand

July 27, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Air Freight Services

Schedule a DemoAir Freight Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Air Freight Services category is 11.30%

Payment Terms

(in days)

The industry average payment terms in Air Freight Services category for the current quarter is 62.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Air Freight Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAir Freight Services market frequently asked questions

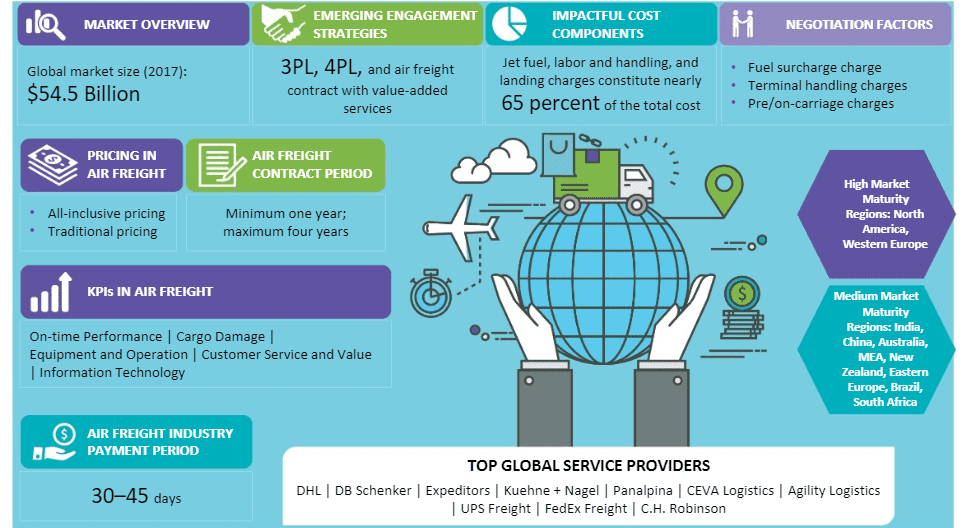

As per Beroe's air freight market analysis report, the global market size of the industry is $54.5 Bn.

According to the cargo industry analysis report, North America and Western Europe fall in the high maturity regions for the industry, while regions like India, China, Australia, New Zealand, Europe, Brazil, and others fall in the category of medium maturity regions.

Beroe shares a quick air cargo industry overview and recent trends which primarily includes the following pointers: -- It's trickier to find data on costing, TCO models, supplier details, and performance benchmarks -- Regional trends majorly impact the cost, supply and other dynamics of the air freight market -- Air freight industry trends also include the negotiation and the sourcing part which is done based on specific categories

As per the air freight industry analysis report, there's a gradual increase in the capacity index, while the available capacity in the air freight market grew by 6.2%. Also, trade disputes between the U.S. and China didn't impact the capacity as AFTK has been consistently growing by 1 ' 3% monthly. Another positive addition as per the air cargo industry statistics worth knowing is that regions like North America, LATAM carriers, and APAC carriers (except Africa) reported steady growth in terms of freight volumes by more than 5% annually. The EMEA showed a growth rate of 3.8%, while the EU recorded a growth of 3.3%.

Air Freight Services market report transcript

Global Market Outlook on Air Freight Services

Air Freight Volumes declined significantly in 2022, compared to 2021, as easing bottlenecks, regional covid outbreaks, geopolitical conflicts and economic uncertainties took a toll on the sector. Market volumes are anticipated to continue to downtrend in 2023 mostly during the first half of the year.

Air Freight Market Analysis

Most of the challenges from 2022 are estimated to persist in 2023. Weak economic conditions, lower ocean freight rates, and absence of traditional peaks indicate lower demand for H1 2023. Air freight volumes are estimated to remain flat in the first two quarters of 2023. Volumes are anticipated to grow only once stronger economies begin to recover, which is forecast in the second half of 2023.

Supply Analysis

-

While the resumption of passenger travel has added to belly-hold capacity, airlines have reduced air cargo capacity in order to control the supply imbalance caused by the Y-o-Y demand decrease since March 2022

-

It is estimated carriers will likely continue strategically adjusting supply in line with increase or decrease of demand in order to minimize freight rate decline and control losses

-

China's decision to end its zero COVID policy is a positive sign for the long run, but the projected rise in infections might harm the country's already suffering economy in the short-term

Demand Analysis

-

In December 2022, available international air freight capacity in the market has remained stable with less than 1 percentage decline compared to December 2021, while international CTK fell by 15.8 percentage as a result of multiple headwinds

-

Much of the demand that was pushed to air by supply chain disruption has now decreased and air freight demand is currently being driven by traditional airfreight commodities like perishables, e-commerce and pharmaceuticals

-

Consumer spending is likely to be tight in the forthcoming months and manufacturing activity is estimated to be slow. Air freight demand is forecasted to be stable but below 2020 and 2021 levels

Regional Demand Analysis

-

Compared to the exceptional levels of 2021, air freight performance decreased due to significant political and economic uncertainty. As a result, air freight demand was 1.6 percentage less in 2022 compared to levels before the pandemic. A further fall in cargo volumes is anticipated in 2023 as a result of key economies' ongoing efforts to combat inflation via higher interest rates.

Regional Demand Trend for Air Freight

-

In December 2022, international airfreight demand had decreased on a yearly basis in all regions except for Latin America, which grew by around 2.3 percentage. This is mainly due to the recovery of the region compared to weaker performance in 2021.

-

Challenges such as high inflation rates in advanced economies, the decline in international trade, the ongoing war in Ukraine, and the unusual strength of the US dollar weighed in on the performance of the air cargo sector

Global Air Freight Rates

-

Strong pent-up demand for international travel has bolstered the availability of belly-hold cargo. The air cargo utilization rates which have remained high since the pandemic, due to capacity constraints have now eased due to additional belly hold capacity and a decline in manufacturing activity.

-

Air freight pricing is expected to stay soft as intermodal congestion has improved and economic indications point to persistent demand shortfalls.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.