CATEGORY

Digital Marketing Services Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Digital Marketing Services Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Digital Marketing Services Australia Suppliers

Find the right-fit digital marketing services australia supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Digital Marketing Services Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDigital Marketing Services Australia market report transcript

Regional Market Outlook on Digital Marketting

The Australian digital advertising market is showing growth to reach $2,263 million in September Q3 2020, growing at a CAGR of 11 percent

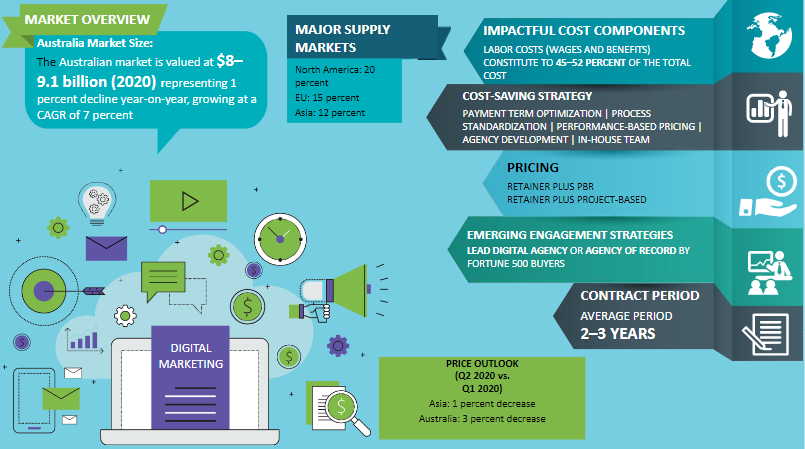

The total digital advertising market is valued at 9.1 billion in for 2020, representing a 1 percent decline year-on-year•Search, directories and general display were up by 3 percent and 0.8 percent in Q3, where classifieds is down by 3.9 percent

The retail sector experienced the largest increase in share post COVID-19, where other sectors travel, real estate and entertainment has declined post crisis.

Market Drivers and Constraints

Digital advertising spend is paused by about 20–22 percent, and 57–58 percent of the marketers have reduced their marketing spend. Companies are focusing more on operational efficiency post COVID-19, but e-mail, social media marketing, pay per click marketing are in focus to target audience.

Drivers

Post-COVID Marketing:

- Pay Per Click Marketing bundled with Facebook Ads and Google Ads for brand recognition and high website traffic. Google Ads Campaigns and Facebook Ads Campaign to reach large number of prospects

- Social Media Marketing, Video, Programmatic Display are the ad forms that are most adapted by marketer's post COVID in AustraliaTargeted Mobile Ad DeliveryEmerging advertising technologies (such as RTB platforms, location-aware, and bandwidth-aware technology tools) are enabling contextually relevant and personalized ads based on device features, mobile internet speed, location, and other factors.

Constraints

- Difficulty in Calculating ROIMost marketers believe that they are not sure about the impact of digital marketing, as they often encounter lack of synergy between marketing and procurement centers. Thus, securing a budget for digital marketing investments becomes difficult because providing a digital marketing return on investment is the most critical challenge.

Porter's Five Forces Analysis: Australia

Supplier Power

- Global agencies with established presence have higher supplier power, but the price points of local agencies and competition in the market brings down the supplier power significantly

Barriers to New Entrants

- High investments in terms of technology and infrastructure to compete with existing agencies and the difficulty in attracting and retaining top talent act as deterrents for new entrants

Intensity of Rivalry

- The competition in the digital marketing space is primarily driven by buyer accounts that do not have long-term contracts with the top agencies and are open to working with the fragmented agency base

Threat of Substitutes

- Threat of substitutes is very low. Traditional field market research studies are still adopted in moderately mature markets of Australia

Buyer Power

- The government in Australia has encouraged investments in digital marketing across industries as internet penetration has increased manifold. The marketers will have higher buyer power as the agencies compete to grab a higher share of the marketer's spend

Digital Marketing Australia Market Overview

-

According to Australian digital market intelligence, paid search advertising remained the highest adopted digital channel with an estimated contribution of around 25–30 per cent of the total digital advertising spend in 2018. The increase in spend on channels like display, social and mobile-centric digital marketing initiatives is expected to slow down the adoption of paid search channel.

-

In order to realize the higher saving potential, marketers are expected to unbundle routine digital production tasks, like trans-creation/versioning and web hosting, from incumbent agencies

-

The average cost savings observed in 2017-2018 from digital marketing production decoupling was around 10–15 per cent.

-

Online videos and mobile ad spend have fueled the overall digital marketing spend in North America and Western Europe. Mobile ad spend that once accounted for around 13–18 per cent of the total digital spend share in 2016, now contributes to around 39–42 per cent of the digital spend in key Western European markets, such as the UK, Germany, and Spain and is expected to reach 55–60 per cent by 2019.

-

Digital marketing Australia market research shows that the maturity of the buyers is medium in Australia. With the increase in spend and growth in the markets, the maturity of the buyer is expected to improve.

-

Emerging advertising technologies such as RTB platforms and location-aware and bandwidth-aware technology tools are enabling contextually relevant and personalized ads based on device features, mobile internet speed, location and other factors

Why You Should Buy This Report

- Information on the Australian digital market intelligence including the market maturity, industry trends, drivers and constraints, local market outlook, key observations, etc.

-

Porter’s five forces analysis of the digital marketing Australia industry.

-

Supplier analysis, trends, insights, category overview, and profiles and SWOT analysis of key players like Havas Digital, SapientNitro, VML Group, etc.

-

Sourcing models, pricing models, KPIs, best strategies, end-user industry updates, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now