CATEGORY

Analytical Testing Services

Labs that evaluate varyig dose formulation of a given API.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Analytical Testing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoAnalytical Testing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAnalytical Testing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Analytical Testing Services category is 1.60%

Payment Terms

(in days)

The industry average payment terms in Analytical Testing Services category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Analytical Testing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAnalytical Testing Services market report transcript

Global Market Size and Growth Forecast –Analytical Testing Services industry

-

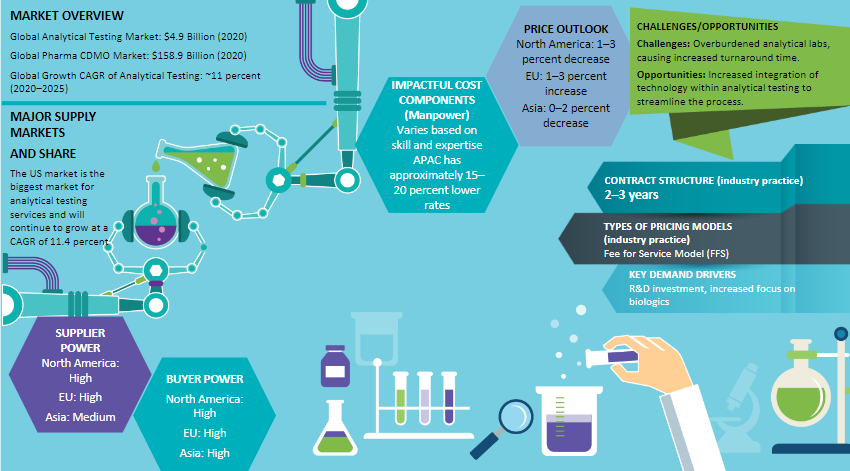

The global demand for analytical testing services is expected to grow at approximately 7.5 percent CAGR through 2021–2026. The current market size is $7.7 billion (2022E)

-

Pharmaceutical companies are outsourcing manufacturing and development services, due to the nature of business being capital intensive, growing demand of biologics and generic medicines

-

North America is the preferred region, followed by Asia Pacific, mainly due to the low cost of operations and continuous evolving nature of regulations

Global Outsourcing Market Trend

-

Outsourcing budgets have increased in the recent years, swinging from contractions to expansion after recession. Pharma is maintaining its stance on outsourcing as a cost-savings strategy, the total global pharma and biotech outsourcing market is valued at $90 billion and this is mainly due to big pharma downsizing and presence of small and niche virtual biotech firms which is rising the outsourcing demand

-

Demands for biologics is a boon for contract manufacturing and contract research organizations and is one of the driving factors for the growth of analytical testing services

-

The global analytical outsourcing market is growing at a CAGR of approx. 8.30 percent and will reach $10.55 billion by 2026F. North America is the preferred region, followed by Asia Pacific, mainly due to the low cost of operations and continuous evolving nature of regulations. The US outsourcing market is growing at a rate of 8.3 percent and is expected to reach $5.5 million by 2027

-

Approximately 40–50 percent of the PDS functions are outsourced to an external supplier, mainly to benefit from the skilled professionals and to access updated analytical testing instruments to yield better results.

Growth Drivers and Constraints : Analytical Testing Services

Drivers

Increased investment in R&D

- Increased investments at the discovery and early development phases are leading to robust pipelines and creating demand for greater clinical--scale manufacturing capacity.

Increase in biologic drugs

- The percentage of expenditure going towards biologics development and outsourcing expenditure have both risen over last year.

Broad array of services offering

- CDMOs are increasingly motivated to offer an expanded array of enhanced drug-delivery technologies, giving their customers broader options for patient care. Delivery technologies can include various targeted and timed release/dissolution and formulation technologies.

Increase in drug molecule complexity

- Drug molecules are becoming more complex and increasingly require both advanced synthesis and formulation expertise to realize cost-effective, efficacious medicines

Constraints

Pressure of cost reductions

- The pressure on pharmaceutical firms to reduce costs was transferred to suppliers, which translated into reduced profit margins for suppliers.

Decline in number of initial public offerings (IPO)

- Without public markets, the industry could see a sharp drop in IND filings, and in the demand for CDMO services, as it did in 2010.

Increasing pharmaceutical In-house capability

- The pharma-biotech are investing significantly in internal manufacturing capabilities, through the expansion of existing or additional new manufacturing facilities and/or the acquisition of production capability

Regional Analysis – Analytical Testing Services

-

Currently, North America is still the leader in analytical testing outsourcing as most analytical scientists and CROs are based in the U.S. and Canada. North America dominates the global market with an approx. market share of 54 percent

-

Pharmaceutical companies in North America and Europe have also been outsourcing analytical testing to a significant degree since the late 1980s. Most of the supply also came up in these locations as local sourcing has been the norm, due to requirement for quick turnaround

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.