The Procurement Beige Book: Summary Sheet

By Valekumar Krishnan, Vice President, and Madhavan Kutty, Digital Transformation Lead

(NOTE: The Procurement Beige Book will be available on Beroe LiVE.Ai, the next-gen Procurement Intelligence platform. If you would like to schedule a demo to learn more about the exciting features such as smart AI assistant Abi, please write to contactus@beroe-inc.com)

The Procurement Beige Book is a quarterly publication of Beroe that assesses and reports the level of favorability in sourcing a comprehensive set of commodities, materials, and products and services. In other words, it shows whether the sourcing conditions are favorable, unfavorable, or neutral for categories.

The Methodology

Category Softness: Beroe tracks the movement in price, input cost, supply–demand balance (or demand for categories where the supply is largely elastic), and market competition. It also identifies whether each of these parameters are favorable, unfavorable, or neutral, based on the direction (increase or decrease) and magnitude of change. The level of favorability of the four parameters is combined to provide a unique indicator called category softness. A higher category softness indicates more favorable sourcing conditions.

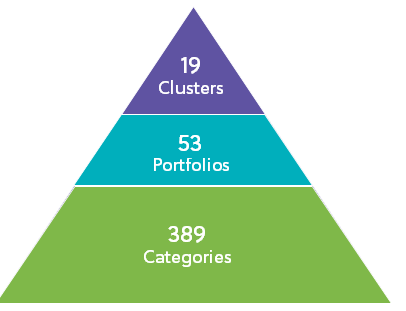

Roll Up: Each tracked category is part of a portfolio of similar categories, and a collection of related portfolios forms a cluster. For each category in a portfolio, the level of favorability across the four key parameters is used to arrive at the level of favorability and the overall softness at a portfolio level. This roll up considers the relative significance of each category in a portfolio. The process is repeated with related portfolios within a cluster to arrive at the level of favorability and overall softness at a cluster level.

The Scale and Scope

The Procurement Beige Book covers softness data for 389 categories, 53 portfolios, and 19 clusters; softness dashboards are available for 319 categories. Our analysts track a minimum of 30 to a maximum of 140 data points per category to provide softness data and dashboards.

Summary

Overall, when all the clusters are considered together, it can be seen that the category softness has remained neutral this quarter.

Unfavorable sourcing conditions have not been observed for any cluster. However, in widely exposed critical clusters, such as freight and employee benefits services, the deterioration of conditions from favorable to neutral will generate a slightly negative but widespread impact across most industries.

Overall, the category conditions have deteriorated marginally in clusters such as chemicals, mining, and marketing services, though they continue to remain in the neutral band. The important indirect spend clusters, such as engineering and construction and staffing services, continue to witness favorable category conditions. From Q3 to Q4 2020, the clusters under consideration have not witnessed significant improvements.

The clusters facing unfavorable conditions also experience a favorable or neutral supply–demand situation at a portfolio level. This indicates a potential improvement in the category conditions in ensuing quarters.

Snapshot of Sourcing Conditions

|

|

Improving |

Stable |

Worsening |

|

Categories |

80 |

221 |

88 |

|

Portfolios |

21 |

14 |

18 |

|

Clusters |

0 |

17 |

2 |

|

|

Favorable |

Neutral |

Unfavorable |

|

Categories |

37 |

344 |

8 |

|

Portfolios |

4 |

47 |

2 |

|

Clusters |

2 |

17 |

0 |

The sourcing conditions of each cluster is discussed as follows

Chemicals:

At the chemicals cluster level, the conditions of six out of nine clusters have deteriorated considerably, while three clusters have remained stable. Although all the nine portfolios fall under the neutral band, there has been an increase in the price and input cost. The latter two parameters have been unfavorable across portfolios such as elastomers, fertilizers, pigments, resins, solvents, and surfactants. The supply–demand situation has transitioned from the neutral to favorable level across all these portfolios, indicating a potential softening in the near future.

The price increase has contributed toward adverse sourcing conditions in categories such as natural rubber, benzene, methanol, polyvinyl chloride, and other resins. Although the industrial acids and bulk chemicals portfolios’ conditions have remained at a neutral level, they have been experiencing more favorable category conditions than those of other portfolios in the chemicals cluster.

Metals and Minerals:

There has been a significant improvement in the conditions in the metals and minerals cluster, with all the portfolios experiencing improved sourcing conditions. Although all portfolios fall under the neutral band, there has been an unfavorable movement in the price and input cost across base and ferrous metals. Since the past few quarters, this cluster has been witnessing unfavorable price and input cost conditions, which may worsen further. However, the supply–demand situation and market competition have been at a highly favorable level across these portfolios, indicating a mild softening if these conditions prevail in ensuing quarters.

Mining:

The conditions have deteriorated slightly in the mining cluster. While all the portfolios have deteriorated marginally, the sourcing conditions have remained neutral. There has been an unfavorable movement in the price and input cost across the equipment, consumables, and services portfolios. However, the supply–demand situation and market competition have been neutral or favorable across these portfolios. Although the equipment category is not expected to show an improvement, a favorable supply–demand situation and market competition can improve the conditions across the more volatile consumables and services portfolios.

Industrial Manufacturing:

At the cluster level, industrial manufacturing has been experiencing a marginal deterioration in the category conditions. The conditions have remained stable and neutral in five out of six portfolios, while the industrial equipment portfolio has experienced a decline in softness. Although all the portfolios fall under the neutral band, there has been an unfavorable movement in the input cost across industrial equipment, industrial processes, and mechanical components portfolios. The supply–demand index and market competition have been stable or favorable across these portfolios and have offset the negative impact of the input cost. The stable to favorable supply–demand index for the critical inputs used for producing the electrical, electronic, and mechanical components can accentuate the positive supply–demand situation and market competition and drive further improvements in subsequent periods.

Energy:

The category conditions have remained stable at the energy cluster level. Overall, the renewable and non-renewable energy portfolios have remained stable and neutral. There has been a neutral to favorable movement in the prices, input cost, supply–demand situation, and market competition, at the portfolio level, for renewable and non-renewable energy portfolios. Although all portfolios fall under the neutral band, the electricity and diesel categories have been witnessing an unfavorable movement in the input cost and supply–demand situation, respectively. The continuation of unfavorable conditions in two of the critical and widely exposed energy categories can hamper further softening or worsen the sourcing conditions in subsequent periods.

Agriculture:

There has been a significant improvement in the conditions in the agro commodities cluster, with 9 out of 10 portfolios experiencing improved sourcing conditions, 2 witnessing deterioration, and 1 remaining stable. Although all portfolios fall under the neutral band, there has been an unfavorable movement in the price and input cost of portfolios such as cereals and grains, dairy, sweeteners, and fruits and vegetables. The continuation of unfavorable price and input cost movements in this cluster could further deteriorate the conditions in the cluster as a whole. However, in these portfolios, the neutral to favorable supply–demand situation and market competition can contribute toward improvement if these conditions prevail in ensuing quarters.

Packaging:

The category conditions have remained stable at the packaging cluster level. The price, input cost, and supply–demand indices and the market competition have remained stable for the flexible, rigid, and paper packaging portfolios. Although all portfolios fall under the neutral band, there has been unfavorable movement in the input for pulp, paper, and corrugated boards. The continuation of these conditions in these critical and widely exposed categories may worsen the sourcing conditions at the portfolio and cluster levels in subsequent periods.

Pharmaceutical Research and Development:

The category conditions have improved marginally at the pharmaceutical research and development (R&D) cluster level. The price, input cost, and supply–demand indices and the market competition have remained stable for the contract research organizations, laboratory services, drug manufacturing services, pharmaceutical materials, and formulations portfolios. There market competition has improved, while other indices have remained stable, for the medical equipment and supplies portfolio. Although all the portfolios fall under the favorable side of the neutral band, the supply–demand situation could be under pressure in three out of five portfolios in the immediate future, and thereby worsen the conditions.

Exploration and Production:

Overall, there has been a significant deterioration in conditions in the exploration and production cluster, with the oil and gas services driving the deterioration. Although both portfolios fall under the neutral band, the input cost movement has worsened unfavorable conditions. In the oil and gas services portfolio, the supply–demand situation has declined from favorable to neutral. Given that the two aforementioned indices are leading indicators of overall softness, their decline implies a potential hardening in subsequent periods.

Indirect Services:

The conditions have been largely stable and neutral across indirect clusters and portfolios, with 8 out of 10 clusters remaining stable in the neutral band. However, the widely exposed clusters such as the freight and employee benefit services witnessed a considerable decline from the favorable to neutral conditions. This decline is likely to impact industries across the board owing to the relatively broad applicability of these portfolios across industries.

Marketing Services: There has been a marginal worsening in the marketing services owing to adverse sourcing conditions caused by a sudden increase in demand for advertising and communication categories.

Corporate Services: There has been a marginal improvement in category conditions driven by continued low demand for travel categories.

Staffing Services: The conditions have been favorable and stable for the staffing services. However, a marginal worsening is expected in subsequent quarters owing to a likely pick-up in demand for temporary labor. However, the price and input cost movements have been firmly favorable and can offset future hardening.

Employee Benefit Services: The conditions for these services have worsened to neutral from favorable owing to worsening conditions in the learning and development category.

Banking Services: The conditions for banking services are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Freight Services: The freight services have deteriorated considerably owing to the unfavorable movement in the price, input cost, and demand for ocean freight services.

IT – Software, Infrastructure, and Services: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Facilities Management: The conditions are stable and neutral for facilities management. Positive conditions are likely to continue in succeeding periods.

Maintenance, Repair, and Operations: Conditions are stable and neutral. Positive conditions are likely to continue in succeeding periods.

Engineering and Construction: The conditions are stable and favorable for engineering and construction. There conditions may deteriorate in the succeeding quarters owing to a likely increase in demand. While the price and input cost movements are currently favorable, they may worsen marginally in subsequent periods.

Category Highlights:

The category conditions are unfavorable for polystyrene, benzene, tin, ocean freight services, and learning and development.

The category Conditions are favorable for sulfuric acid, lime, almonds, cashew nuts, menthol, tallow, salmon, shrimp, mechanical, electrical and plumbing services, engineering and design services, and plastic collapsible tubes

Category softness improved the most for linear low density polyethylene, high density polyethylene, low-density polyethylene, propylene glycol, aluminum, nickel, stainless steel, almonds, barley, cocoa, tallow, shrimp, high-fructose corn syrup, mechanical, electrical and plumbing services, general/ civil construction services, hotels, and car rentals.

Category softness worsened the most for polystyrene, polyethylene terephthalate (PET), phenol, ethylene glycol, xylene, soda ash, ethyl acetate, methyl isobutyl ketone, molybdenum, refractories, vanillin, yeast, soybean, beef, ocean freight services, and learning and development services.

However, the supply–demand index has been stable to favorable for categories like PET, ethylene glycol, xylene, soda ash, ethyl acetate, molybdenum, refractories, vanillin, yeast, soybean, and beef, among others, indicating a potential improvement in ensuing periods.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

I