The Procurement Beige Book Summary Sheet -- Q3 2022

What is The Procurement Beige Book?

The Procurement Beige Book is a quarterly publication from Beroe that assesses and reports the level of favorability in sourcing a comprehensive set of commodities, materials, as well as products and services.

The Methodology

Category Softness: Beroe tracks the movement in price, input cost, supply–demand gap (or demand, in the case of categories where supply is largely elastic), and market competition, and it identifies whether each of these parameters is favorable, unfavorable, or neutral based on the direction (increase or decrease) and magnitude of change. The favorability levels of the four parameters are combined to provide a unique indicator called “Category Softness.” A higher category softness indicates more favorable sourcing conditions.

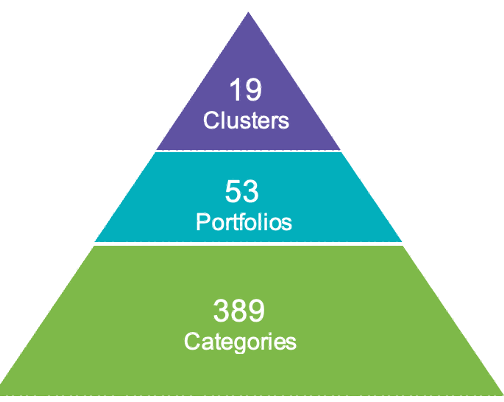

Roll Up: Each category that is tracked is part of a portfolio of similar categories, and a collection of related portfolios constitutes a cluster. The level of favorability across the four key parameters for each category in a portfolio is used to arrive at the level of favorability and overall softness at the portfolio level. The relative significance of each category in a portfolio is considered in this roll-up process. This process is repeated with related portfolios within a cluster to arrive at the level of favorability and overall softness at the cluster level.

Scale and Scope

The Procurement Beige Book covers the softness data for 389 categories, 53 portfolios, and 19 clusters. Softness dashboards are available for 319 categories. Our analysts track a minimum of 30 to a maximum of 140 data points per category to provide softness data and dashboards.

Summary

Category softness on the whole, when all clusters are considered together, continues to be neutral in this quarter.

No cluster as a whole witnesses heavily unfavorable sourcing conditions. The chemical cluster is expected to witness improved sourcing conditions in Q4, leading to a positive impact on downstream clusters, such as “packaging.” Conditions in other clusters are expected to be relatively stable and witness only marginal movements at the cluster level from Q3 to Q4 2022.

Sourcing Conditions’ Snapshot

|

|

Improving |

Stable |

Worsening |

|

Categories |

103 |

195 |

91 |

|

Portfolios |

19 |

25 |

9 |

|

Clusters |

1 |

17 |

1 |

|

|

Favorable |

Neutral |

Unfavorable |

|

Categories |

39 |

330 |

20 |

|

Portfolios |

10 |

40 |

3 |

|

Clusters |

2 |

17 |

0 |

Chemicals:

Conditions are expected to be favorable in the chemical cluster, with conditions improving in eight portfolios and stable in one. Although the cluster as a whole, as well as eight portfolios, fall in the neutral or favorable band, the supply–demand gap is unfavorable in portfolios such as industrial acids and fertilizers. These conditions are expected to stabilize in the next two quarters.

Metals and Minerals:

The conditions remain neutral at the metals and minerals cluster level and have witnessed mild softening. Conditions in the metals portfolio are likely to improve in Q4, whereas the minerals portfolio is witnessing a slight worsening toward unfavorable sourcing conditions. Unfavorable conditions of the past few quarters appear to be easing slightly in Q4 2022 with the supply demand situation improving in many categories. However, input cost and price conditions are likely to worsen due to high energy costs.

Mining:

Conditions are likely to remain stable from Q3 to Q4 2022 in the mining cluster. All portfolios are expected to witness a mild improvement, although the sourcing conditions are neutral. Price and input cost conditions are likely to improve across equipment, consumables, and services in Q4 2022 with the supply–demand situation, as well as with market competition remaining neutral or favorable across these portfolios.

Industrial Manufacturing:

Fairly stable category conditions continue in the industrial manufacturing cluster. The supply–demand scenario in the electronic components portfolio is expected to continue in the unfavorable territory in the near to medium term, while conditions in the industrial processes and mechanical component portfolios continue to be in the neutral to favorable territory. A stable to favorable supply–demand index for critical inputs into electrical and mechanical components could continue to drive improvements in subsequent periods.

Energy:

Category conditions are not expected to worsen further and will continue to be in the neutral to unfavorable zone during Q4 2022. Although all portfolios fall in the neutral band, the price and input cost indices are unfavorable for natural gas, electricity, diesel, and renewable energy. Stable to marginally favorable supply–demand conditions in many of these categories indicate a potential softening in subsequent periods.

AGRO:

The conditions are neutral in the agro commodities’ cluster. The price index is unfavorable across dairy, sweeteners, fruits, vegetables, and so on. The supply–demand situation and market competition are neutral to favorable across 9 out of 10 portfolios, signifying a potential improvement if these conditions prevail. The conditions in the dairy portfolio are anticipated to improve owing to the onset of a favorable peak milk season in Oceania.

Packaging:

Category conditions are neutral at the packaging cluster level, with all three portfolios in the neutral territory. However, conditions are likely to improve marginally in rigid and flexible packaging portfolios, with price and input cost indices becoming neutral and supply–demand conditions in a stabilizing band during Q4 2022. However, the negative impact of high energy costs is likely to mitigate a strong move toward favorability. An anticipated increase in pulp prices is likely to keep paper packaging in the neutral band during this period.

Pharma R&D:

Category conditions are neutral and improving marginally at the pharma R&D cluster level. Contract research organizations, drug manufacturing services, pharma material and formulations, and medical equipment and supplier portfolios remain neutral, with the price index and input cost index continuing to be neutral in each of these portfolios. Although the price index is unfavorable for the contract research portfolio, the input cost index, demand index, and market competition improved at the portfolio level. The input cost index is expected to remain unfavorable for lab services and pharma materials and formulation portfolios in Q4 2022.

Exploration and Production:

Conditions remain stable and favorable in the exploration and production cluster with the oil and gas services portfolio, witnessing an improved supply–demand index and market competition in Q4 2022. Price and input cost indices have stabilized in both portfolios, while the supply–demand index is likely to remain stable through Q4 2022. Improving market competition and stability in price, input cost, and supply–demand indices across both portfolios indicate continued favorability of category conditions in the upcoming periods.

INDIRECTS:

The conditions that are largely stable and neutral across Indirect clusters and IT and staffing services portfolios are likely to witness improved sourcing conditions in Q4 2022 portfolios relative to Q3 2022. The demand index for most portfolios has rebounded, and labor shortage will continue to adversely affect most portfolios through Q4 2022

Marketing Services: The conditions are stable and neutral across the marketing services portfolio. Demand continues to grow for key categories in the portfolio and the impact of inflation is likely to kick in in ensuing quarters.

Corporate Services: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Staffing Services: The conditions are stable and neutral. Demand to continue to be stable.

Employee Benefit Services: The conditions continue to be neutral at a portfolio level.

Banking Services: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Freight Services: The conditions will continue to be neutral, bordering on unfavorable. The sluggish supply of ocean freight to continue.

IT – Software, Infrastructure and Services: The conditions have improved and are likely to stabilize through Q4 2022 and Q1 2023.

Facility Management: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

MRO: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Engineering and Construction: The conditions are stable and neutral. Positive conditions are likely to continue in subsequent periods.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

N

U

S

M