Data-Driven Sourcing Decisions

Only 14% of CPOs have access to a real-time data ecosystem

to support sourcing decisions

-McKinsey

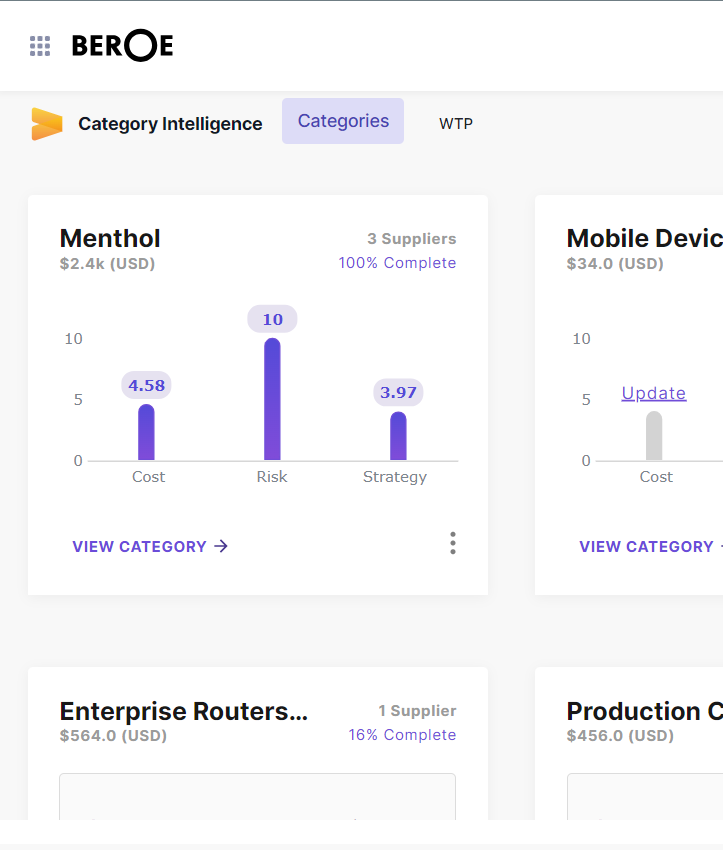

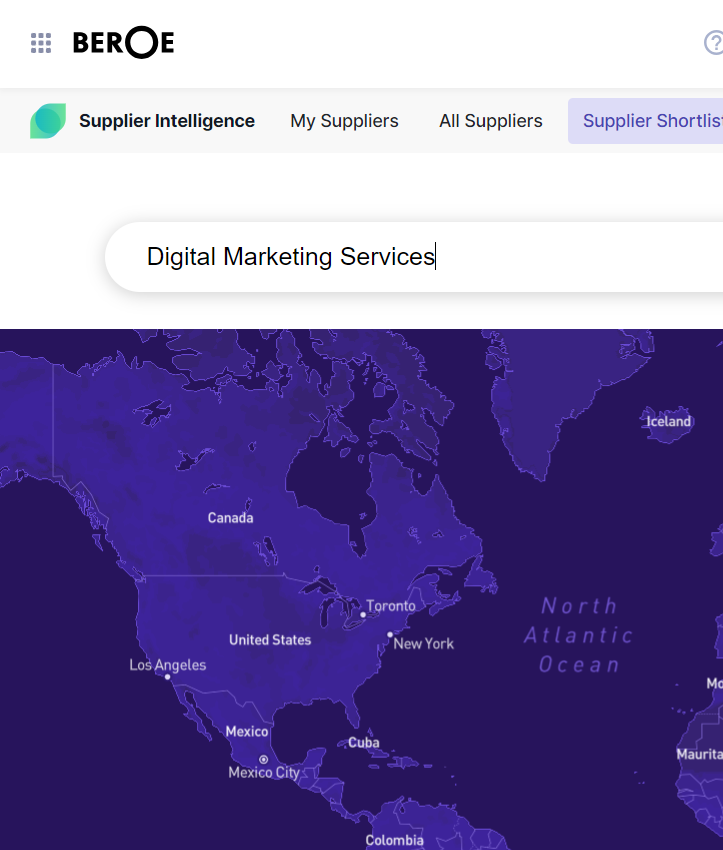

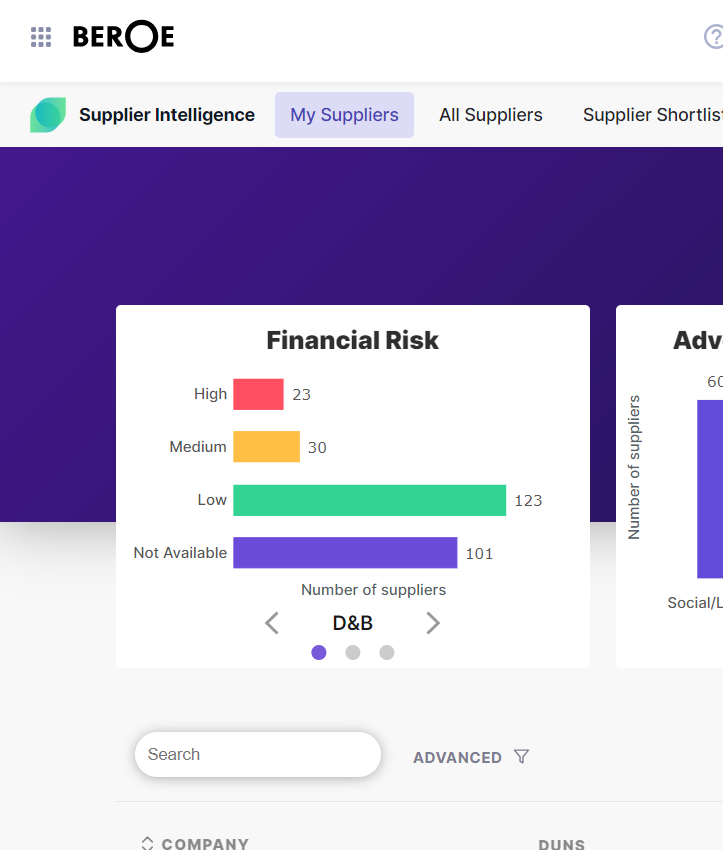

Beroe Enables Every Sourcing Decision with

Data, Insights and Intelligence

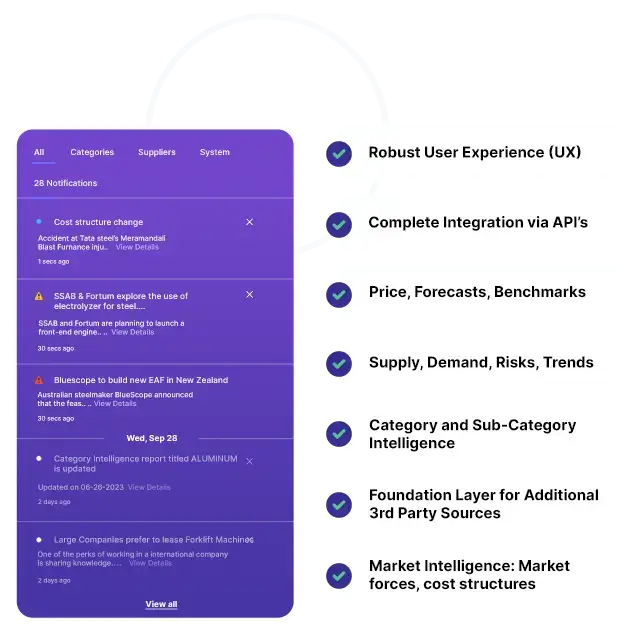

Seamless Access to Data Ecosystem

When you need it, Where you need it!

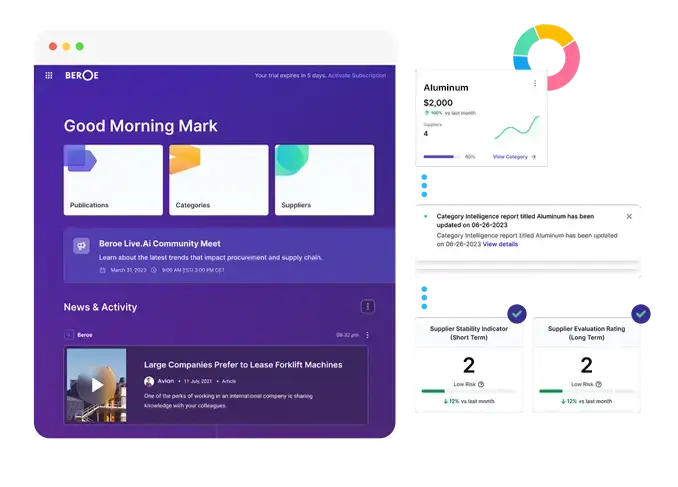

Beroe LiVE.Ai

PROCUREMENT PRODUCTIVITY SUITE

AI-Powered Procurement Intelligence Platform for all your market intelligence needs

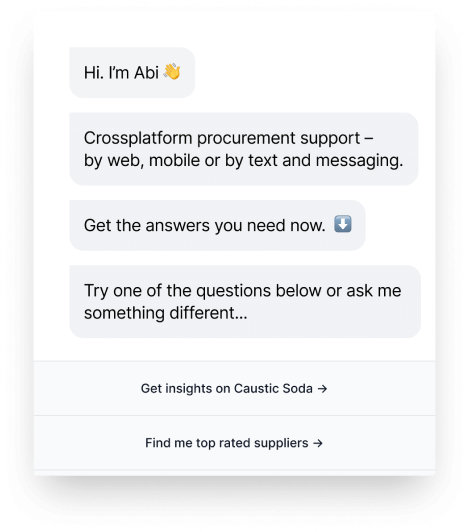

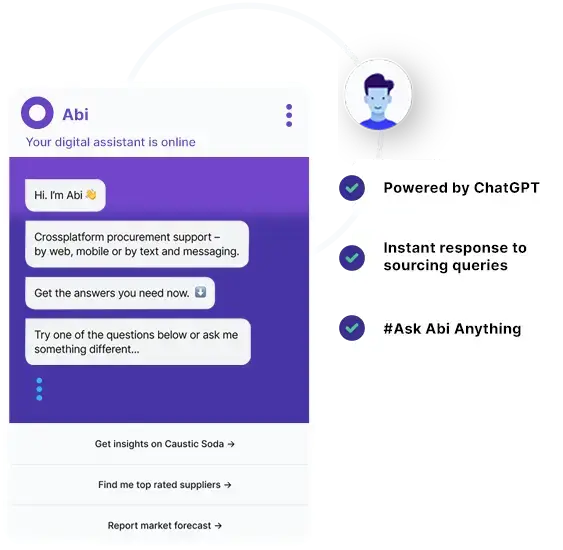

Abi

CONVERSATIONAL-AI

Get your sourcing queries resolved instantly by World’s first conversational-AI digital market analyst

Procurement Platforms

WORKFLOW INTEGRATIONS

Beroe’s data and insights are embedded in the leading platforms to manage procurement workflows

Beroe Pulse

DATA API INTEGRATIONS

Integration of 7.4 Million Discrete Data Elements that are business critical for procurement

Fortnightly e-Magazine

Explore the biggest procurement stories from the world’s most widely read procurement magazine

In this interview with Beroe, Dr. Rob Handfield explores the intertwined roles of digital innovation and emerging supply chain challenges. He highlights the transformative impact of AI and digital twins in procurement, alongside the strategic shift towards nearshoring and evolving inventory management in a rapidly changing landscape.

In an exclusive interview with Beroe, AJ Karliner, the CPO of Victoria State Police, discusses the critical role of a robust supply chain in public service delivery. He highlights his strategic approach to procuring essential items and services, from tactical gear to IT solutions, underlining the importance of evolving procurement practices in the public sector.

Category Forecast 2024 report provides detailed forecasts for 12 key procurement categories, aiming to offer clear insights and actionable intelligence for this year.

Every two weeks, Beroe delivers expert interviews, opinion pieces, and detailed analysis on breaking issues affecting the world of procurement and supply chain

LIVE EVENTS

Espresso LiVE:

Join interactive virtual events featuring CPOs and top procurement leaders tackling real-life procurement challenges and sharing best practices

Espresso LiVE: Recession proofing Procurement Operations

Danijel Banek

CPO of Atlantic Grupa

For the past 18 months or so, we witnessed a “commodities super cycle” and unprecedented supply tightness. However, recent data indicates that the tide is beginning to turn: prices and con...

Espresso LiVE: Rethinking Digital Procurement

Dr. Elouise Epstein

Partner - Kearney

Trade wars, pandemic, and supply chain disruption have pushed Procurement to the forefront, but is the function fully equipped to handle today’s as well as tomorrow’s challenges with the help of c...

Maximizing Value Delivery Beyond Savings

Sebastien Bals

CPO of Belgian Pharma major UCB

Global supply chains are in continuous turmoil. Procurement Organizations across the globe are rethinking their operating models to become agile and nimble with value delivery in focus....