Sourcing Managers Expect Annual Cost Savings of up to 5 percent

Cost reduction continues to be the number one priority for Procurement leaders across the globe. Year-on-year savings performance has improved to 61 percent of Procurement functions in 2018, up from 58 percent the previous year, according to the Deloitte Global CPO survey.

The earnings outlook also looks good for Corporate America. As per a report by FactSet, a market data firm, U.S. companies are set for one of the strongest quarterly earnings seasons in a decade.

Second quarter earnings for European companies (STOXX 600) are expected to increase by 8.1 percent from Q2 2017. Excluding the energy sector, earnings are expected to increase 2.9 percent, according to Thomson Reuters I/B/E/S.

While manufacturers are booking more orders and delivering higher profits in a strong U.S. economy, investors are worried that the good times won’t last: Costs are rising at some of the biggest industrial companies due to tariffs and a super-tight labor market, according to a report by the Wall Street Journal.

Given this background, we ran a poll among users of Beroe LiVE, a community of thousands of Procurement decision makers, to ascertain expected percentage of cost savings in their respective spend areas for the financial year 2018–19.

- Thirty-six percent of the respondents—a majority—said they expect yearly savings to be between 2% and 4.99%

- Twenty-four percent of the respondents expect savings of between 5% and 7.5%

- A little more than one-fifth of the respondents said they expect savings to come in excess of 7.5 percent

- About 17 percent are expecting anywhere between 0% and 1.99% of annual savings in the current year.

Role of Market Intelligence

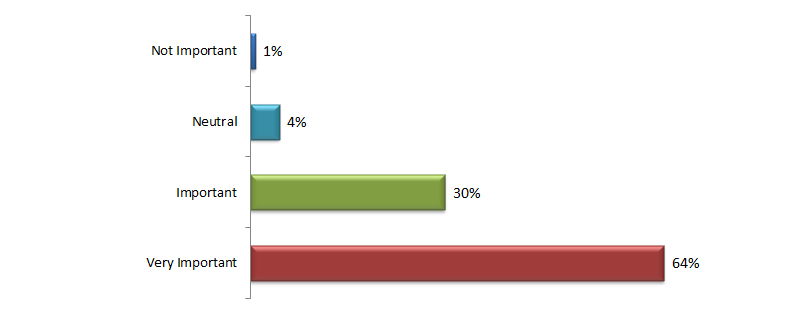

Only 1 percent of those polled said Market Intelligence (MI) plays no role in achieving cost savings objectives.

While 64 percent said MI is very important, 30 percent of the respondents said deployment of MI is important in achieving their cost savings objective.

The role of Procurement / Market Intelligence to achieve your cost savings objective:

Company size, industry and operational structure will also inform how procurement approaches a key barrier to MI adoption—budget.

Even though companies are increasingly acknowledging the importance of using MI, finding the necessary funds to support such an initiative can often be a challenge. Thus, it is important to consider which departments will ultimately be asked to pay for external MI, how much the company can afford and what the expected return on investment on a new program could look like. (Please click here to read more)

“Market Intelligence is a very important tool to the procurement department as it provides insights on the effects of macroeconomic and political changes, allows deep monitoring of suppliers and competitors, and several other market indicators,” Fernando Mero, Head of Procurement at Brazilian e-commerce company Netshoes Inc told Beroe.

Once adopted, MI will help save costs as it enables Procurement teams in key areas, such as:

1. Supplier Selection—Finding the Right-Fit Supplier

While there are multiple suppliers in the market, identifying and selecting the right supplier who can fulfill the organizational requirement is time-consuming for Procurement professionals. Supplier intelligence can help in preparing a long list of suppliers for the RFI/ RFQ process.

2. Curtailing Maverick Spend

Maverick spend is an unplanned or uncontrolled spend, which increases the overall cost of Procurement. A department may be prompted to buy materials or services independently, without involving the Procurement teams. A lack of a centralized Procurement system often leads to this problem.

An MI platform that provides easy access to vendor details and product/ service prices could be useful, as the information can be shared internally with business stakeholders in order to avoid maverick orders.

3. Measurement of Supplier Performance

Assessing supplier performance is an essential element of Procurement operations. More often than not, key performance indicators (KPIs) and benchmarking data are not commonly available. This makes measuring supplier performance a tough task, especially in several categories that fall under indirect spend.

Organizations can benchmark their suppliers against industry peers to identify problem areas by effectively using MI. This helps them make informed decisions on supporting the suppliers in improving their performance and competitiveness.

4. Simultaneous Tracking of Multiple Marketplaces

While generic category intelligence is widely available in the alleyways of the Internet it is not always easy to locate relevant, reliable and specific intelligence that would fit the buyer’s sourcing context. MI provides the necessary inputs, such as market size, market potential and supplier coverage, for businesses interested in market expansion. As each market varies in terms of demand and supply, Procurement teams can adopt MI to make decisions that suit their global and regional operations.

5. Effective Utilization of Time

Procurement teams always run a tight schedule. Amidst the constant factor of a time-crunch, gathering intelligence will not be a priority, as it is a labor- and time-intensive effort. Further, not all organizations have a full-sized MI team to be constantly surveying the markets and suppliers.

Overall, Market Intelligence can improve the security of the bidding processes, the quality of the decisions and identify new acquisition trends, Mero of Netshoes said.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe