The ongoing Mexican standoff over NAFTA can impact procurement operations

Diplomatic relations between U.S. and Mexico have soured early in the new year, as the Trump administration threatened to impose a 20 percent tax on Mexican imports, leading to the cancellation of a meeting between the presidents of the two countries.

U.S. President Donald Trump has said that his government will renegotiate the North American Free Trade Agreement (NAFTA) trade deal with Mexico and Canada. The new administration, which is not a big fan of multi-country free trade deals, also walked out of the proposed multi-lateral trade deal Trans Pacific Partnership (TPP).

For his part, Mexico President Enrique Peña Nieto began a 90-day consultation process to remake NAFTA.

The fast pace of changes on the trade and immigration front has caught many businesses by surprise. Reuters News reported late in January that U.S. food producers and shippers are trying to speed up exports to Mexico and line up alternative markets as concerns rise over trade and immigration at the country’s southern border.

Some U.S. producers of corn, soybean meal and distillers dried grains (DDGs), an ethanol byproduct, are trying to accelerate sales to Mexico because they are uncertain about the risk for new tariffs to disrupt trade, Rafe Garcia, general manager for U.S. operations at shipper Primos & Cousins USA, told Reuters.

The news report shows how some companies are working overtime to minimize as much adverse impact as possible.

Corporate America is divided over taxing imports. One group of companies comprising of big conglomerates such as GE and Boeing launched a group known as “America Made Coalition” on Feb. 3 to back a House Republican proposal that would cut corporate income tax to 20 percent from 35 percent, exclude export revenue from taxable income and impose the 20 percent tax on imports. (http://beroeinc.co/2k8Avhk)

Meanwhile, the Retail Industry Leaders Association, which represents more than 120 trade associations and companies, launched a separate coalition on Feb. 2 to fight the House Republican proposal known as the "border adjustment" tax. (http://beroeinc.co/2k2ZwYX)

U.S. Mexico Trade

U.S. goods and services trade with Mexico totaled an estimated $583.6 billion in 2015. Exports were $267.2 billion; imports were $316.4 billion. The U.S. trade deficit (including services) with Mexico was roughly $50 billion, while goods trade deficit with Mexico was $58 billion in 2015, according to data published by Office of the U.S. Trade Representative.

U.S. import of Mexican goods included:

- Automobiles -- $74 billion

- Electrical machinery -- $63 billion

- Machinery -- $49 billion

- Mineral fuels -- $14 billion

- Optical and medical instruments -- $12 billion

Automobiles and auto parts are the biggest imports from Mexico. However, imposing a flat import tax on automobiles produced in Mexico is a tricky affair because tens of thousands of parts that make up a vehicle often come from multiple producers in different countries and travel back and forth across U.S. – Mexico borders several times, making it difficult to determine the origin of production.

For example, more than half the parts in the Ford Focus today are made outside the U.S. and Canada, including 20 percent in Mexico. Ford also ships in some of the car’s engines from Spain and transmissions from Germany, according to Wall Street Journal.

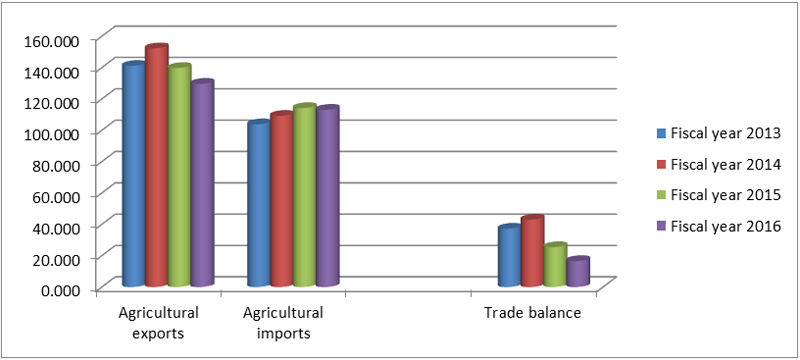

While U.S. has a trade deficit with many countries in goods and services, it has had a positive trade balance in the agricultural sector since 1960. U.S. farmers could potentially be caught in the crossfire of any trade war as Mexico and China are two of the top three agricultural export destinations.

(In Billion dollars. Source: U.S. Department of Agriculture)

Trade Agreements

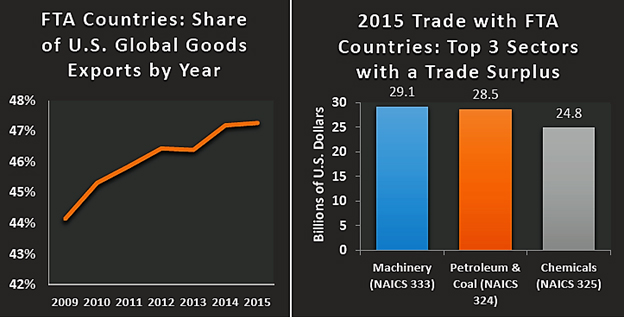

The U.S. has trade agreements with 20 markets worldwide. Free Trade Agreement (FTA) partners comprised 10 percent of global Gross Domestic Product (current U.S. dollars) in 2015, according to data published by U.S. Department of Commerce. U.S. exports to FTA countries amounted to $710 billion in 2015.

Source: U.S. Department of Commerce | International Trade Administration

Free trade agreements inherently led to phased elimination of tariffs as well as many non-tariff barriers to trade. FTAs involve billions of dollars of trade flows and the main beneficiary has been small and medium enterprises (SME), whose exports in 2013 to FTA countries (latest available) was $192 billion.

Article 2205 of NAFTA allows the U.S. President to withdraw from the agreement. But it is being debated whether that would repeal the congressional legislation that put it into effect, the WSJ said.

If a trade deal is repealed then World Trade Organization (WTO) tariff schedule will apply. This would imply that U.S. exporters to Mexico would face greater tariff hikes than Mexican exporters to the U.S., because Mexico accepted much greater tariff reductions under NAFTA than the U.S. did, as per WSJ.

Pointers for Procurement Organizations:

This is a time of great uncertainty. It’s tough to predict the outcome of NAFTA renegotiations. Considering the fact that it is tricky to figure out all the pieces of the puzzle, what are the pointers for procurement organizations?

- Businesses that are based in U.S, Canada and Mexico and are negotiating with suppliers on the opposite territory, it is better to refrain from signing long-term deals when contracts come up for renewal in the next few months. As of now we are in open waters and don’t know yet what course will eventually be charted by the policymakers.

- Renewal of existing contracts can also face some turbulence since there may be some confusion as to what legal framework needs to be adopted if NAFTA breaks down completely.

- In case NAFTA goes away then it can have an immediate impact on logistics and warehousing. Custom costs, paper work and waiting times across the borders are bound to go up. Also, the choice of warehouse can become a challenge for those companies with interlinked supply chain across the three countries. This may result in an overall increase in logistics and warehousing costs.

- Import tax/tariff is a threat that can throw lot of calculations out of the window. It’s better to scout for tax consultants to work out cost-benefit/scenario analysis.

- For those businesses that may have to relocate staff across U.S., Mexico and Canada because of potential regulatory constraints, now is the time to plan for and open negotiations with relocation service providers. Movement of hundreds of staff across borders in case of adverse political or policy developments can be a daunting task and may need careful planning and budgeting.

- Trump administration has vowed to revamp immigration laws, which are bound to have an impact on businesses. Buyers should audit their workforce to understand the immigration status and also review the employment contract and policies.

- The proposed changes to H1B visa program can lead to an increase in visa and immigration-related costs for IT and Software services suppliers. IT and Software service providers will reconsider their onshore-offshore resource mix. Global IT outsourcing companies will also be assessing the number of staff working (implementation, support) in the U.S. and will plan to optimize their resources.

- In case of restrictions being introduced around workforce mobility because of new immigration laws then it would lead to a shortage of talented workforce. Blue-collar labour shortage could impact industries such as retail, agriculture, mining and construction.

- Shortage of migrant workers could cause an escalation in wages. Buyers should negotiate with their existing payroll providers for achieving better cost-effective deals.

- As a plan B, procurement organizations can shortlist suppliers from alternate regions, especially if the raw material or service is critical to one's business.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe