Interview: Reshoring May Lead to More High-End Manufacturing in the U.S.

(Pic Courtesy: Rosemary Coates)

The COVID-19 pandemic has led to significant disruptions in global supply chains, creating a pressing need to establish a robust local manufacturing base, particularly in the United States.

The shifting of production and jobs to low-cost countries in Asia, notably China, has made the establishment of a local manufacturing base a key political issue in the U.S.

President Biden has prioritized revitalizing American manufacturing, strengthening critical supply chains, and positioning U.S. businesses and workers to lead globally in the 21st century. The “Made in America” plan has further fueled interest in reshoring with nearly $80 billion in planned investments in semiconductor manufacturing and more than $100 billion in announced investments in electric vehicles, batteries, and critical minerals since 2021. While some reports estimate that 6,96,000 manufacturing jobs have been added in the 20 months since President Biden took office1, a closer examination is needed to fully understand what is happening on the ground.

Beroe spoke to Rosemary Coates -- a veteran Supply Chain consultant and an author of five books on the subject -- to get a sense of what type of manufacturing is being relocated to the U.S. She is the Founder and Executive Director of the Reshoring Institute, a non-partisan non-profit organization dedicated to promoting U.S. manufacturing. She also serves on the Board of Directors at the University of San Diego Supply Chain Management Institute and teaches Global Supply Chain Strategy at UC Berkeley.

It was 10 a.m. in San Francisco when Rosemary received Beroe’s video call.

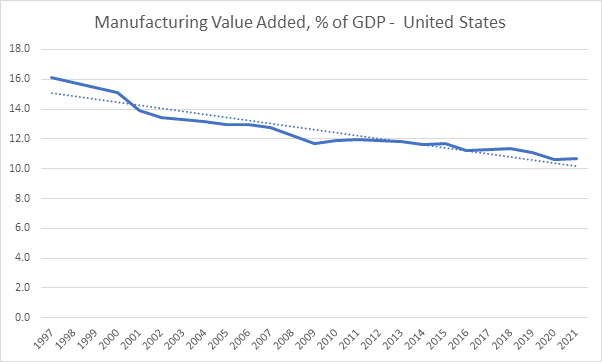

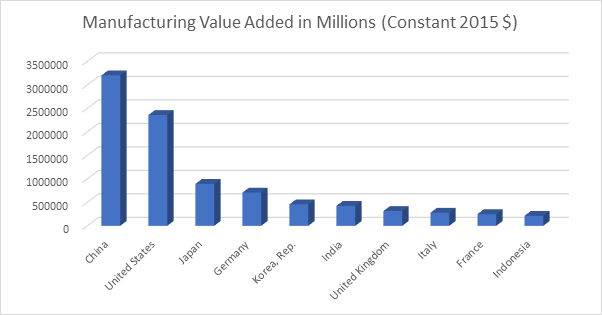

If one looks at the data, U.S. is still the second largest manufacturing country after China, yet there is lot of debate about bringing manufacturing back to the U.S. When do you think the movement to reshore manufacturing jobs earnestly begin?

Yes, you are right about the U.S. being the second largest manufacturing country in the world after China. However, the share of manufacturing as a percentage of GDP has been on the decline ever since China joined the WTO and began playing a larger role in the global supply chains.

(Data Source: World Bank)

One could say the seeds of reshoring was sown during the presidential election in 2012 when the two candidates -- President Barack Obama and his challenger Mitt Romney -- were China-bashing, and the U.S. had experienced a significant decline in its manufacturing industry, with GDP related to manufacturing dropping over the years. This decline continued until about the COVID-19 pandemic in 2020, when the emphasis began shifting towards companies bringing their manufacturing back home. The year 2012 was the ignition point for reshoring to start, and in response, I assembled a team to help companies re-evaluate their global manufacturing strategies. We did not just focus on bringing everything back to the U.S., but rather on rethinking the lay of the land around the world and looking at other areas like India, Vietnam, Thailand, Indonesia, and Mexico. The reshoring movement began 10 years ago, and while it was slow at the beginning, it gained momentum after the pandemic.

Companies started looking at risk as a factor in their decision-making process and realized that their supply chains were long and subject to many risks. This perspective added a sense of urgency to the reshoring movement, and most companies now recognize that their supply chains are risky and subject to geopolitical risks in Asia, among other things.

(Data Source: World Bank)

Can you also tell us a bit more about the Reshoring Institute?

The Reshoring Institute was started as a public service and is affiliated with 14 universities. We conduct native research, publish white papers and case studies. All of our publications are free. My background is primarily in global supply chain and Chinese manufacturing, as I spent 15 years helping companies offshore to China. As for me, personally, after spending so much time helping companies offshore, I am now trying to give back by doing some good to offset the damage that was done over those years.

The outsourcing of manufacturing jobs to China and other low-cost countries was primarily due to the lower labor costs in those regions. However, your recent study highlights that China is no longer as cost-effective in this regard. Given this shift, what types of manufacturing processes do you believe can be viably reshored to the U.S.?

We assist many companies in reducing their manufacturing costs by automating the process. It's clear that setting up a manual labor factory in the U.S. is economically unviable. Currently, the U.S. has low unemployment rates, so in order to establish a factory here, automation is necessary. We're not interested in bringing back unskilled labor jobs, but rather in focusing on more sophisticated manufacturing jobs that require skilled workers to operate machines and robots. This creates a skills gap, not an economic gap. These jobs pay a living wage, which is essential to avoid relying on welfare.

Our aim is to improve the U.S. manufacturing profile by shedding low-efficiency, lower-cost assembly jobs to low-cost countries like India, where economic development is a priority. When talking to clients, we discuss all options and help them decide where to manufacture. Many companies choose to bring some manufacturing back to the U.S., as it offers a fresh start with automation and a new supply chain. We acknowledge that there may be fewer jobs coming back, but they are higher-skilled, higher-paying, and better for the U.S. economy.

There are varying estimates of how many manufacturing jobs are coming back to the U.S. In fact, politicians use the manufacturing sector job creation as a “success metric”. Any ballpark figure as to how many jobs in the manufacturing sector has come back to the U.S. due to the latest reshoring trend?

I always tell people that it's directionally correct -- manufacturing jobs are coming back to the U.S. Figuratively speaking, the jobs went out like a tsunami, and now they're coming back in rain drops -- but they're higher skilled and pay better. There's probably a few hundred thousand manufacturing jobs coming back to the U.S., but you can't depend on those numbers. The other reason is that there's nobody gathering real statistics. A lot of companies don't publish what jobs they're adding or eliminating, so that stuff just isn't available. Also, we should include those companies that originally planned to move manufacturing to China but decided not to and stayed home to begin with. That's a kind of reshoring that needs to be included. Additionally, foreign direct investment goes up and down, so we need to watch that as well. Companies that buy U.S. manufacturing entities or set up manufacturing here wouldn't be included in those numbers. So, directionally it's correct, but depending on specific numbers is impossible to validate.

Can you share which product lines or industries are showing promise in terms of returning to the U.S.?

We receive inquiries from various types of companies, particularly in the plastics industry where mold making can be expensive, costing up to $100,000 in the U.S. compared to $10,000 in China. However, the actual production of the plastic products is coming back to the U.S. due to the need for quick product turnaround.

This trend is also observed in the semiconductor industry, where investments have been made in seven or eight different states in the U.S. to build high-tech manufacturing plants. Despite the importance of the semiconductor industry to the U.S. economy, these plants are highly automated and do not generate many jobs.

Another area where we see a trend of reshoring is in the pharmaceutical industry, where companies are duplicating factories in the U.S. to mitigate the vulnerability in making antibiotics and some of the building blocks of pharmaceuticals.

Similarly, in the apparel industry, sewing shops for high-end brands are making a comeback in the U.S., but not for sewing for big retailers like Walmart. On the other hand, the automotive industry is not coming back to the U.S., with about 80% of the companies we work with moving their automotive parts business to Mexico.

We also observe a trend called "local for local," where companies decide to manufacture locally for the local market, while maintaining factories around the world.

Around last year, Goldman Sachs published a report stating that companies preferred building inventory instead of factories in the U.S. as it was cheaper. Does it make economic sense to bring back industries closer to the consumer market in the U.S., especially those with fast-moving demand?

Yes and no. Manual, labor-intensive products like iPhones and athletic shoes will continue to be manufactured overseas as the process requires too much labor. For example, each colored square on the bottom of an athletic shoe is individually glued by a person in a factory. However, industries that are closer to the consumer market and have fluctuating demand could benefit from reshoring factories in the U.S. For instance, those with automation or those that are less labor-intensive. Though some assembly work is being done in the U.S., the majority of the labor-intensive manufacturing will likely stay in low-cost markets overseas.

So basically, you're saying that if a product line requires less labor, then it makes sense to reshore it, regardless of whether it needs to be close to the market or not. However, if it is labor-intensive, it is less likely to come back to the U.S. Is that correct?

I would say it's not going to come back to the U.S., but it's likely to move out of China. We are seeing a trend of companies moving away from China due to various factors such as the geopolitical situation and concerns over China's control of rare earth elements. This is leading to an interest in reshoring or moving production to other countries. For instance, there is now significant investment in the U.S. to research cleaner ways of refining and mining rare earths, which are crucial for electronics. There are major rare earth deposits in Montana that have been discovered and are accessible, and I believe we will see more of this kind of mining and refining develop in the future.

We are not aiming to bring back the 23-cent-an-hour T-shirt production to the U.S. Our focus is on skilled manufacturing, where workers can operate robots and machines, requiring a different set of skills. However, we have a skills gap and need people with expertise in running machine tools, 3D printing, and other computer-related areas. These jobs pay a living wage in the U.S., which is important for economic growth. We want to move up the maturity curve in manufacturing, using automation to become more efficient and economically viable. Our goal is to have a manufacturing profile comparable to top countries like Germany and Switzerland. The less efficient and low-cost sewing and assembly jobs will be moved to other countries like India, where it is an economic development opportunity. We want to see a rise in living standards in developing countries, just as it happened in China.

If labor-intensive industries move out of China, which countries will benefit?

India and Vietnam are popular destinations, but Vietnam has limitations due to its population size. Mexico is also a strong contender due to its proximity to the U.S. market and the USMCA trade agreement between Mexico, the U.S., and Canada. Mexico is a low-cost country that competes with India and Vietnam -- especially if you locate the factories in the interior parts of the country -- and has the added advantage of being able to quickly and easily transport goods across the border into the U.S. without waiting at the port. Thus, Mexico is an attractive option for labor-intensive industries seeking an alternative manufacturing location.

What are some important criteria that companies should consider before reshoring back to the U.S.?

When consulting with companies on reshoring projects, we have a list of about 30 components, but we prioritize based on certain factors. Companies should first identify the highest value parts -- as well as critical parts that could be of low value -- in their bill of materials and consider whether those parts could be manufactured locally. They should also focus on rebuilding manufacturing for high-risk or strategic parts that cannot be sourced from other countries easily. While decisions are typically made based on economic factors, gut instincts can also play a role in decision-making especially if the risk is high. For example, it’s a high-risk situation if you don’t have the building blocks to make antibiotics -- and companies may choose to produce locally to reduce vulnerability, even if it's more expensive. Additionally, companies should consider environmental factors and look at shortening supply chains to reduce their environmental footprint and address issues such as recycling and pollution. This variable factor comes up over and over again.

What are the criteria to get the "Made in USA" label?

The criteria for the "Made in USA" label are determined by the U.S. government's Federal Trade Commission (FTC). The law requires that all or nearly all of the components and labor of the product must originate in the U.S., with around 95% of the product's value being attributed to parts and labor originating in the U.S. However, since it is difficult to meet this threshold, many companies label their products with qualifications, such as "assembled in the USA from world source parts" or "assembled in the USA from domestic and foreign components". These qualified claims are also regulated by the FTC and are still attractive to U.S. consumers.

The labeling of products to provide a good profile and to meet federal regulations, such as the Buy America Act and the content requirements for government goods, is a common discussion among our clients. The U.S. government is the biggest consumer in the world and is required to purchase American-made goods before going overseas. The current content requirement for government goods is 60% made in the U.S., which is set to increase to 65% in 2024 and 75% in the future.

Did your study show that U.S. consumers are willing to pay extra for goods made in the U.S.?

Yes, we conducted a survey of 500 individuals and asked them whether they prefer to purchase products that are manufactured in the U.S. and labeled as such. The response was overwhelmingly positive, indicating that consumers do prefer to buy U.S.-made products. We also asked if they would be willing to pay more for these products, and again the majority responded affirmatively, with most indicating they would pay an additional 10-15% for U.S.-made goods. Our research has shown that if our consulting clients can manufacture their products within 15% of the costs in low-cost countries, they can charge a premium for their U.S.-made products, resulting in a winning outcome.

So what are the some of the top reasons why companies would like to reshore to the U.S., from your client interaction?

In my experience, the top reason is risk mitigation, followed by the potential for increased automation in manufacturing. And thirdly, some companies have a desire to practice "economic patriotism," which means bringing manufacturing back to the U.S. because it's seen as the right thing to do. This is a kind of ethnocentrism on a smaller scale, and reflects a desire among some American manufacturers to produce their goods in the U.S.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

D