Interview: Procurement Managers Must Adopt Supply Chain Finance as a Standard Practice

(Pic Courtesy: Erik Hofmann)

Supply chain finance (SCF) is an important lever for managing a company’s working capital requirements. It also ensures the suppliers are paid on or before time.

An effective working capital management system aims to increase the accounts payable period (DPO) while reducing the accounts receivable period (DSO) and inventory retention time (DIH). A key metric in working capital management is the “cash conversion cycle”. Procurement teams are essential in managing the payment terms and inbound inventories with suppliers.

A very common SCF instrument is reverse factoring, a method by which companies pay their suppliers without using their own working capital. Financial institutions -- ranging from traditional banks to fintechs -- enable this trade funding activity by acting as the intermediary between Procurement Organizations and Suppliers.

The demand for SCF spiked due to the ongoing COVID-19 pandemic as companies across the globe sought to improve liquidity -- while industry experts have raised concerns over aggressive funding practices. Naturally, the question arose as to whether the procurement function should generally be concerned about the recent collapse of a high-profile SCF intermediary, Greensill Capital.

Beroe posed this question to Erik Hofmann, Professor and Director, Institute of Supply Chain Management, University of St.Gallen, Switzerland. Erik is a supply chain specialist and has written several books on Operations Management and SCF.

“No, Procurement need not worry about the collapse of Greensill because the SCF market is much more than the troubles faced by one particular company. The SCF market has grown up and several solution providers range from traditional financial institutions to new-age fintechs. In a way, the Greensill episode may even further foster the evolution of the fragmented market into a strong SCF ecosystem,” Erik said in an exclusive interview with Beroe.

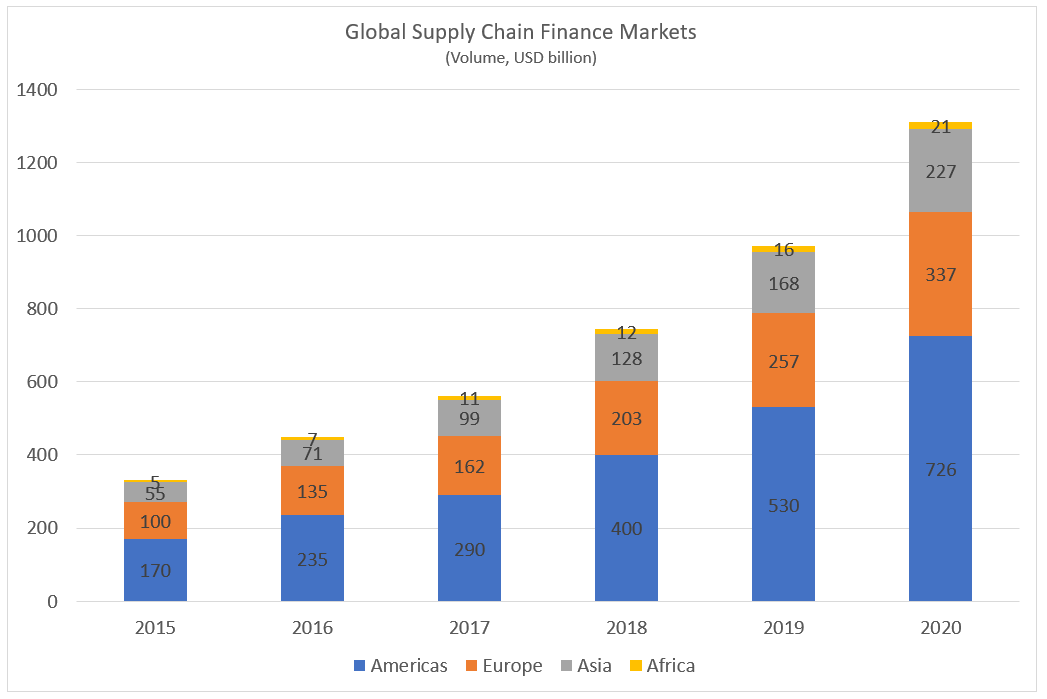

Determining the exact size of the SCF market is challenging. Various figures have circulated in the community. A current estimate of the SCF market, according to Fitch Ratings, is about $1.3 trillion.

When asked about the percentage of total accounts payable outstanding across the globe currently covered by SCF products, Erik quipped: “Oh it is hard to say. Still, I would assume it is not more than 10 percent. It is really a guess, but it underlines the fact that there is a huge growth potential”.

(Source: Fitch Ratings)

SCF As A Standard Tool

Erik advocated that SCF should be a standard practice in the toolbox of every purchasing executive.

“Procurement professionals should be aware of this practice. SCF should go hand in hand with working capital management. SCF is all about using the supply chain to fund the organization and using the organization to fund the supply chain. And so, the purchasing department should always make it a point to analyze the company’s current net working capital requirements, basically arrive at the number by adding accounts receivables and inventories and then subtract the accounts payables,” he said in a professorial tone that one is used to hearing in university lecture halls.

Erik further stated that it is logical for Procurement teams to benchmark themselves against industry peers on parameters such as accounts payables, net payment terms, and cash conversion cycle time.

“Benchmarking will help identify the appropriate level of net working capital that is required to run a company and its supply chains. After all, you do not want to have too much capital tied up in the value creation processes,” he said.

Traditional banks offer SCF solutions besides a plethora of fintech companies. More fintech start-ups are emerging in the SCF space, offering innovative products based on interoperable platforms, blockchains, and artificial intelligence.

“The rise of new fintech solutions makes it challenging for companies and the purchasing departments to choose the right collaboration partner. There is a problem of plenty, but it is a good problem to have. Some players offer tried and tested practices, while some new firms offer solutions that can be termed as ‘offbeat’. It is for each company to decide which solution provider would be the best for them,” according to Erik.

Cross-Functional Team

A company’s finance team is usually responsible for keeping a tab on the working capital requirements; however, Erik said it is crucial for Procurement to partner with the finance function to manage working capital in the supply chain effectively.

Simultaneously, he also stated that, very often, Procurement teams have not had the opportunity to develop a broader view on the working capital issues from a supply chain perspective.

“I think the procurement function is incentivized and hence focused too much on short or mid-term savings. This, in general, prevents them from taking a long-term outlook, and the implementation of an SCF program is a mid-to-long-term undertaking. Hence, the launch of an SCF program should in any case have the support of the top management.

Material flow can be construed as the physical side of the supply chain, while the net working capital components, together with the activity costs, can be considered as the financial side of the supply chain. It is imperative to have a cross-functional team to manage both the physical and financial sides,” Erik elaborated.

According to him, a cross-functional team is a must for the smooth implementation and management of SCF practices.

A cross-functional team must comprise:

- Treasury department

- Procurement department

- Accounting department (to perform the correct accounting of the respective transactions)

- IT team (as they would be required to integrate the SCF solution into the company’s ERP systems)

- Legal department (to ensure covenants are not breached due to the implementation of the new SCF)

- Company auditors (to ensure the correctness of transactions with the accounting guidelines)

- Trade credit insurance (to hedge the risks for the funders)

- The SCF solution provider (who provides the solution including the platform)

“From my observation, two-thirds of all SCF programs are led by the Treasury department, and one-third is led by the Purchasing department. And for a successful implementation, you also need to take your suppliers along, especially your key suppliers. The supplier on-boarding process is crucial. And the alliance between Treasury and Procurement is the most crucial for a successful implementation of the SCF solution,” he explained.

Besides the day-to-day management, a key task for the SCF program owners is developing relevant key performance indicators (KPIs) to measure the progress and the bottom-line impact of the SCF program, according to Erik.

New Trends in SCF

While listing new trends in the world of SCF, Erik emphasized that it is more than just plain-vanilla reverse factoring.

He listed the following trends that are gaining momentum:

Dynamic discounting (DD): The company uses its own cash to pay suppliers, albeit by applying a discount for early payment. Unlike regular discounting, the transaction is generally conducted via an SCF platform. The earlier an invoice is settled, the higher the discount.

Reverse securitization: An enhanced form of reverse factoring, where the accounts receivables of various suppliers are bundled and securitized and then sold to investors in capital markets.

Sustainable supplier financing: This method combines SCF principles with environmental, social, and governance (ESG) and sustainability issues. The buyer can define the specific sustainability criteria. Those suppliers scoring high on the ESG criteria can receive preferential conditions as part of the SCF program. However, choosing the right sustainability criteria remains a large obstacle to sustainable supplier financing adoption.

Purchase order financing: These solutions provide early payment to suppliers. This is not based on approved payables like in reverse factoring or in DD. Instead, it provides an early payment option to suppliers based on the purchase orders (PO) issued by the buyers—a kind of an advance payment.

Deep-tier financing (DTF): This method provides liquidity to the long tail in the supply chain —to the tier-2, tier-3, and tier-n suppliers. This will ensure a company’s key tier-2 and 3 suppliers are provided with the required working capital. DTF aims to increase long-term viability in the supply chain by funding sub-suppliers.

Supply chain trade finance (SC-TF): A hybrid solution mainly used in cross-border transactions. SC-TF combines the features of documentary credit and a classical SCF solution. Funding is granted early against the shipping documents. Suppliers are paid at the time of shipment (not when the invoice is approved by the buyer).

“I Am Not Your Banker”

What if a company does not have an SCF program, but the suppliers ask for early payment to meet their working capital needs?

“I think first of all you have to assess if the supplier is important to you or not. If the request for early payment comes from a non-strategic supplier, than you can say ‘Okay, I understand your situation, but I am not your banker’. But jokes apart, there are other classical approaches. For example, you can ask the supplier to tap into supply chain trade finance. There are players who offer solutions focused only on suppliers, that is, they finance a company’s Accounts Receivables.

On the other hand, if a supplier is essential to you, then your company can arrange for finance against some quality collateral that they can come up with. Overall, the best approach is to have an open and honest communication with your important suppliers about their financial condition—because if they are nudging for early payment, either they are worried about their finances or worried about your finances! Of course, you cannot talk to all the suppliers, it is practically impossible. You would need a tool-based approach to assess financial risk of your entire supply base—but that is another topic altogether,” Erik concluded.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

D

B