How the price of a bottle cap is related to movements in crude markets?

In collaboration with Himanshu Sati, Research Analyst -- Packaging Polymers and Akshat Singh, Senior Research Analyst -- Oil & Gas

In the past couple of months, global crude oil prices have fallen off their highs. Since June, surplus crude oil from the U.S., Middle East and Russia, along with low demand from China and Europe has pushed down the prices by almost 30 percent.

WTI (West Texas Intermediate), which is used as a benchmark for pricing crude oil in North America, went below the $80 mark and Brent, benchmark for more than half of the world's oil, was last hovering around $81.

There are a number of petrochemical commodities that are interlinked with crude oil. Resins such as Polypropylene (PP) and Polyethylene (PE) have been traditionally derived out of crude.

Resins are very useful form of plastics that go into making wide range of products such as water bottles, bottle caps, food packages, toys, crates, and many such things.

In a way, PP and PE has a bearing on the buying decisions of category managers in charge of products that are made of these resins.

And most, if not all, of the buyers are from CPG and Pharma industries because it is where most of the packaging materials are used. For procurement teams in these two industries, the price movements of PP and PE are not very apparent since the end-use products are way down the value chain.

It is important for these procurement managers to know the evolving market dynamics of these resins so that they become aware of the key cost drivers.

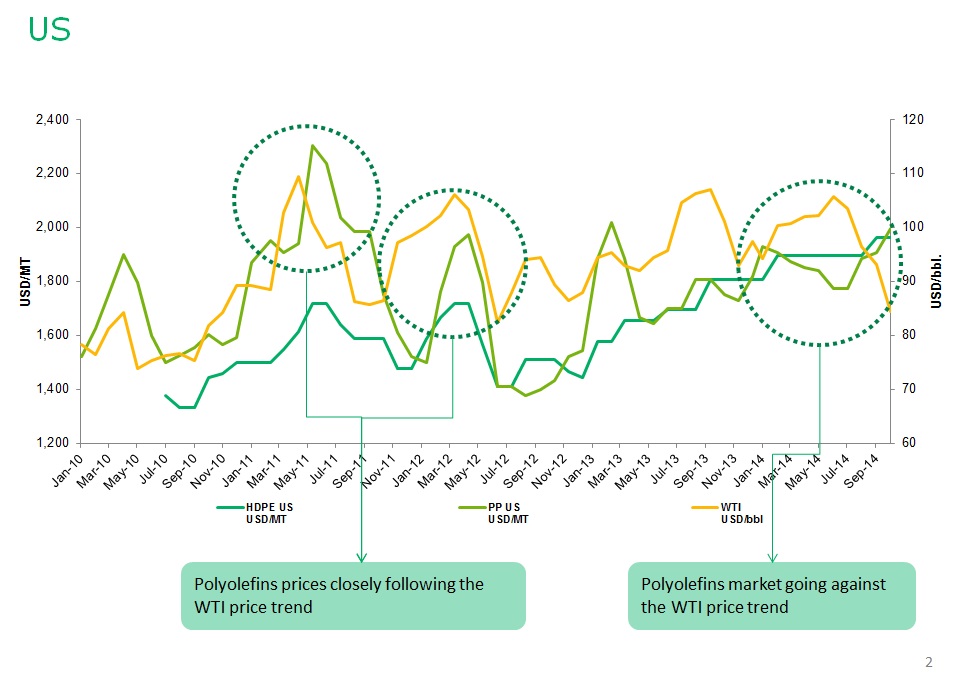

The conventional wisdom is that any price change in the crude oil markets is bound to affect the prices of PE and PP. However, the prices of PE and PP in the U.S. - one of the largest markets - are beginning to buck that trend. A fall in the prices of WTI hasn't had the same impact on the prices of these two resins.

As can be seen in the below chart, it is clear that since November 2013, the resin prices have largely begun to decouple from crude oil prices.

Note: Resins are also known as Polyolefins.

The chart makes it clear that category managers in charge of buying, say, bottle caps need to know that the resin prices, which have traditionally mirrored crude prices, are in fact beginning to move in the opposite direction.

Why is this trend playing out now? What has changed to bring about this shift? The answer lies in the feedstock mix.

Traditionally, Naphtha - a byproduct of crude oil - acted as the feedstock for both Polypropylene and Polyethylene. Naphtha, which is a heavier fuel mix, produces about 23 percent Ethylene and 13 percent Propylene.

Lately, U.S. producers of these two resins have switched over to natural gas feedstock - thanks to lower prices brought about by shale gas boom.

Natural gas produces 80 percent Ethylene and only 3 percent Propylene. And sustained use of natural gas feedstock can potentially cause a supply crunch of PP. However, there is not much reason to worry as a wave of Propane Dehydrogenation (PDH) plants is scheduled to hit the U.S. propylene market in the next 5 years, bringing in additional volumes with a price dynamics of their own.

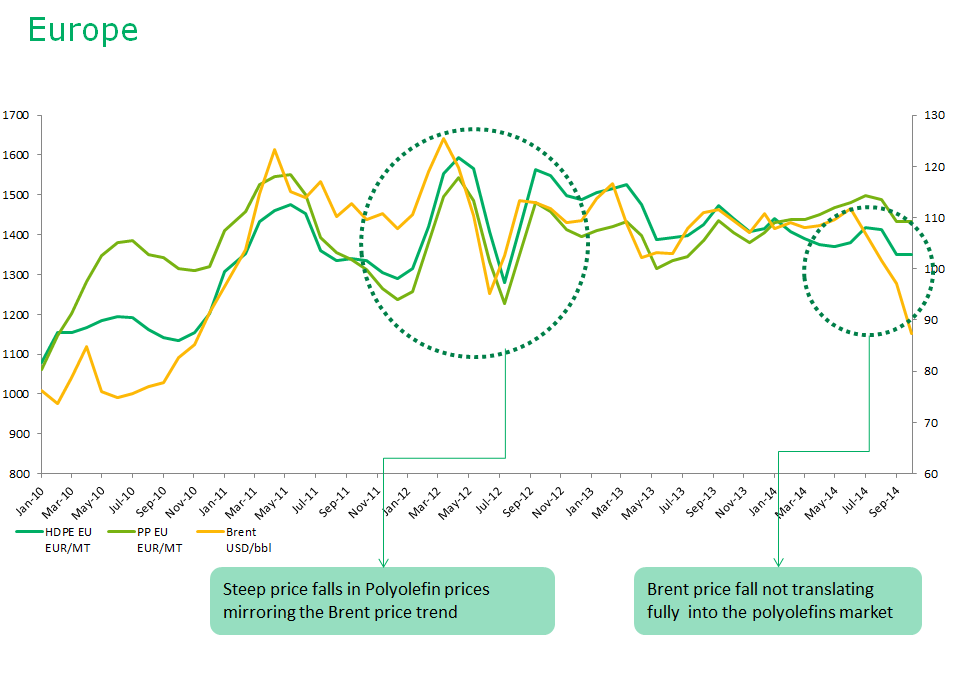

European markets, on the contrary, continue to play by the old rulebook. As is evident from the below chart, prices of PE and PP continue to mirror that of Brent crude.

In sharp contrast to the U.S., Europe has not embarked on the shale gas bandwagon owing to environmental concerns. European producers continue to depend on crude feedstocks to produce the two most important resins.

Long story short: owing to technological changes and evolving market dynamics, the simple one-on-one relation between crude prices and resins has now been disrupted - at least in the U.S. markets.

Category managers, whose products are far down the petrochemical value chain, need to be aware of such disruptions because the price of base feedstock gets built into the final product price. For example, what's the use in still following crude price movements when the supplier has already switched over to natural gas? Owing to this decoupling, only those buyers who operate in the European spot markets can realize some bit of lower prices.

As a category manager in charge of buying end-use products made of resins, it becomes necessary to be aware of what's happening north and south of the value chain. Feedstock mix is one of the key cost drivers of these end-use products. And if you are a buyer of flexible packages, pet bottles or even bottle caps, such information can come in handy the next time you negotiate with your suppliers.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe