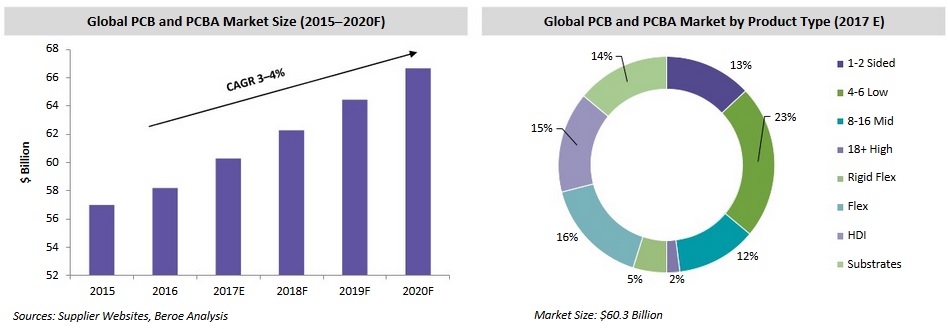

Category Scan: Printed Circuit Boards Market to reach $66.6 billion by 2020

The global Printed Circuit Board (PCB) and Printed Circuit Board Assembly (PCBA) market is expected to grow at a CAGR of 3–4 percent until 2020, driven by the likely rise in demand from the automotive and electronic industries in the Asian countries.

Technological advancements in product types and the expected increase in demand for substrates can also drive the growth of the global Printed Circuit Boards Assembly (PCBA) market.

The global market for Printed Circuit Boards is expected to grow at a CAGR of 3 - 4 percent to reach $66.6 billion by 2020.

The APAC region contributes to more than 90 percent of the global production of PCBs and is expected to be an essential influencing factor for the PCBA market until 2020. Moreover, the presence of major electronics manufacturers in China, Japan, Taiwan, and South Korea such as Samsung, Sony, Panasonic, etc., is expected to contribute to the growth of the PCBA market by 2020.

Cost Breakup

Labor and utility cost accounts for 65 - 80 percent of the total production cost of PCB, which includes processes such as drilling, plating, finishing, and photo etching. The increasing cost of labor and electricity is a hindrance for the PCB manufacturers, as it might affect their margin and profitability. However, the growth of PCB designs can maximize the utilization and minimize cost. This includes replacement of base materials, which is said to support the development of the global PCB market.

Supplier Overview

The PCB market is fragmented with the top 10 suppliers accounting for 33 percent of the global market, and nearly 91 percent of the global PCB and PCBA production is directed in APAC. With a shift in the manufacturing base of end-use industries to countries such as China, Taiwan, South Korea, etc., there is going to be an additional application of PBCs on a global scale.

Consumers of high volume PCBs have high negotiating power due to the fragmented nature of the market. On the other hand, consumers of low volume PCBs have low to moderate negotiating power due to the criticality and design complication of the PCBAs.

Key Findings

- Verticals such as Business, Retail, Computers, and Telecom Communications collectively hold 60 percent of the global PCB market and are presumed to maintain the power. This is due to the technological innovations and growing demand for such products in emerging economies.

- China leads the PCB production in the APAC region, accounting for nearly 43 percent of the global production followed by South Korea with 16 percent, and Taiwan with 14 percent.

- Manufacturers of PCBs for high volume products have low to moderate supplier power. Meanwhile, for low volume products, their power would be high due to the design complexity and specifications.

- The growing demand for digitalization in developing and underdeveloped countries is expected to drive the demand for PCBs and PCBAs on the industrial and consumer fronts.

- Regulations with regard to safety and automation are the key growth factors for the demand of PCB in the European automobile industry.

Sourcing Channels

The sourcing channels differ by the high volume and low volume based applications.

High volume industries are expected to opt for Model I, which encompasses the contract manufacturers along with inventory maintained by them.

Model II is typically followed by low volume, high critical, high-cost PCBs, which are typically used in industries such as the automobile industry, military, and industrial electronics.

To know more about PCB market, please logon to Beroe LiVE: https://live.beroeinc.com

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe