Amidst rising demand, corrugates prices to remain stable all through 2016

In collaboration with Bharathram, Senior Research Analyst, and Ragavendran Thiagarajan, Associate Spend Pool Lead – Packaging

The holiday season is coming up and Christmas is the biggest commercial holiday in the United States, generating huge sales for many retail businesses.

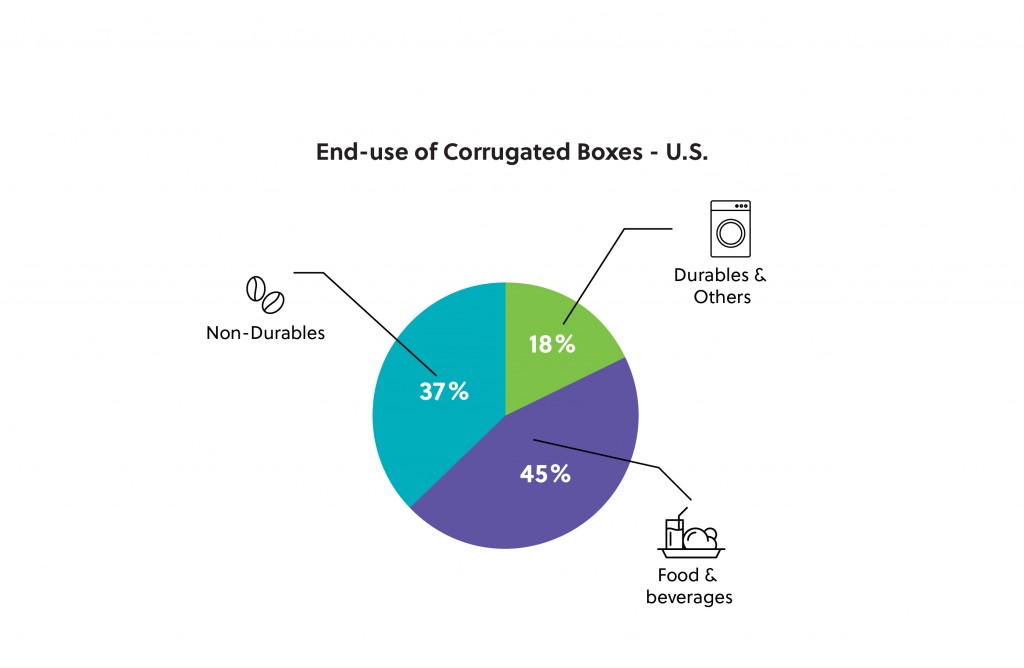

The rise of Internet and App economy has seen people placing online orders and getting their products delivered at their doorsteps. The rise of online retail has spurred the demand for cardboard/corrugated boxes, specialty packaging as well as paper bags.

Approximately 50-60% of the products sold online (by the likes of Amazon or BestBuy etc) are through corrugated boxes. Brick-and-mortal retail share of the same is also significant.

Total holiday retail sales for 2014, which include November and December sales, increased 4 percent to $616.1 billion. In addition, non-store holiday sales, which is an indicator of online and e-commerce sales, grew 6.8 percent to $101.9 billion, according to National Retail Federation. Most, if not all of these items would need corrugate package.

In the period from 2015-2018, retail e-commerce spend is expected to increase at a CAGR of around 10% (11% of all sales by that time will be online and will continue to increase in the long term).

Sourcing teams are confronted with usual set of challenges: demand, supply and price of the material.

Given the growing demand of corrugated boxes, should procurement managers worry about dwindling supplies and, as a consequence, rising prices?

The answer is No. The good news is that supply of corrugated boxes is increasing at a much faster rate than demand.

How does the future look for the Containerboard market?

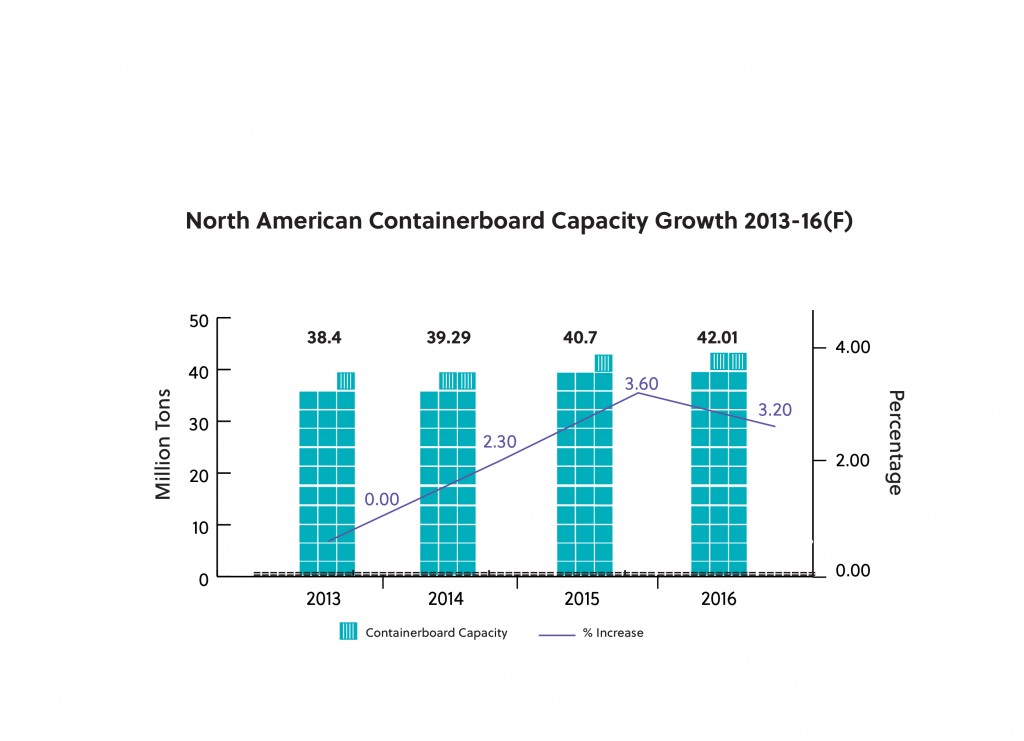

On the Capacity Front:

There are three more machines from Pratt, Corrugated Supplies and Greif that will start production by end of Q4’15. All these three machines put together can produce 575,000 tons/year of containerboard. While 520,000 of the new capacity will be recycled containerboard, the rest will be semi-chemical medium. Post these additions there are no announced or scheduled expansions until mid of 2017 when Kruger plans to kick off production at its newly converted machine producing light weight recycled containerboard.

On Supply/Operating Front:

Producers are well aware of these upcoming new supplies and the effects on the industry. Hence over the next 6 months, large integrated producers will be looking to take significant downtime. We expect the operating rates to go down to 91-93%.

Feedstock Prices:

NBSK pulp prices are expected to increase during the beginning of 2016 and then settle for stability as both capacity and demand changes do not look significant. OCC prices can tumble due to the ongoing weakness in the Chinese Market which will lead to increased availability in the U.S. domestic market.

Conclusion:

Overall, procurement managers can rest easy as the prices of containerboard will stay stable for most parts of 2016 on the backdrop of ample supplies. However, it is clear that there is higher pressure on Recycled containerboard and Semi-chemical medium prices (as expansions are more on that front). Unbleached Kraftliner might also be burdened with decrease in exports on account of strong U.S. dollar and weakness in global markets. Hence, prices cannot avoid a fall if producers fail to take significant downtime and reduce their operating rates especially in the recycled containerboard and Semi-Chemical market. All these possible developments will be beneficial for sourcing managers.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe