Ongoing migrant crisis can impact freight movement within Europe

In collaboration with Mohammad Azhar, Domain Lead -- Warehousing and Distribution

Germany and Hungary re-imposed border controls early in September as European nations struggle to cope with thousands of asylum seekers arriving every day.

Border controls, albeit temporary, significantly impacts road transport -- and businesses have already raised concerns about a re-imposition of passport checks on truck drivers and others engaged in cross-border activity.

In the near term, temporary border controls could disrupt the free-flow of goods across EU countries, and subsequently would have a significant impact on time-sensitive business (just-in-time logistics) such as groceries, fresh produce and car parts.

For example, the recent Calais crisis led to a traffic jam stretching upto 36 miles between France and UK, which cost £750,000 per day to the haulage industry. However, as of now it is not possible to predict the scale or duration of disruption since migrants continue to arrive in Europe.

Sebastian Lechner, managing director of the federation of Bavarian transporters told news outlet France24 that Bavaria, crisscrossed by major European transport routes, has been hardest hit by border checks so far.

All the goods traffic from Italy, a major German trade partner, transits Austria and Bavaria, Lechner added.

The loss in earnings for Dutch transport companies alone would amount to 600 million euros ($684 million) a year, assuming a one-hour delay for each border, Renee Reijers, spokeswoman for the Dutch association for transport and logistics, told France24.

The value of cross-border trade between EU Member States has grown from 800 billion euros in 1992 to 2.8 trillion euros in 2013, according to Eurostat.

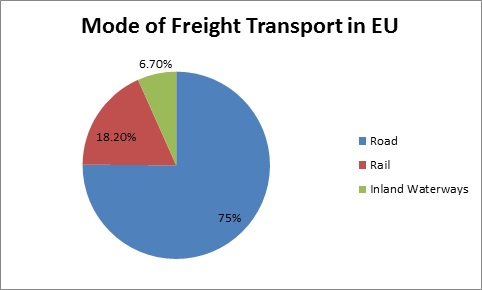

Total inland freight transport in the EU-28 was estimated to be close to 2,100 billion tonne-kilometres (tkm) in 2012 and nearly 75% of this freight total was transported over roads.

The share of EU-28 inland freight that was transported by road was more than four times as high as the share transported by rail (18.2%), while the remainder (6.7%) of the freight transported in the EU-28 in 2012 was carried along inland waterways.

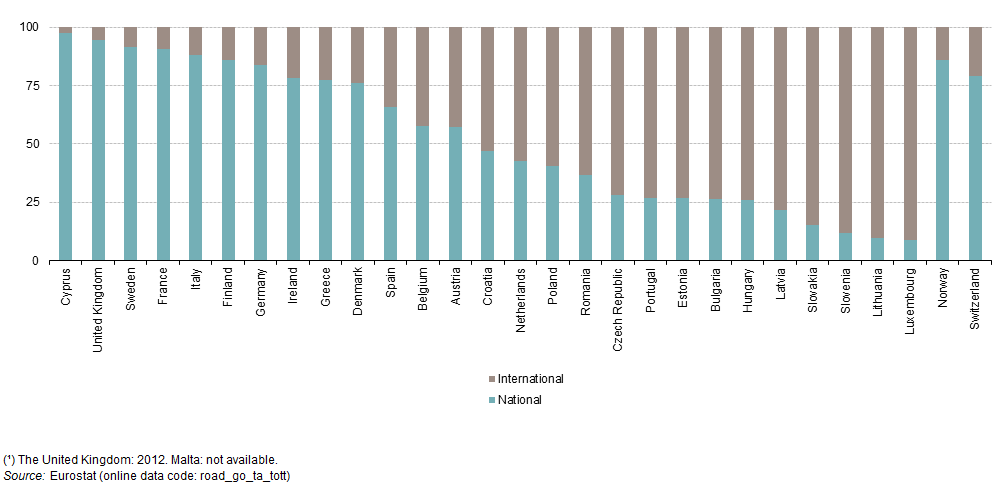

NATIONAL AND INTERNATIONAL ROAD TRANSPORT OF GOODS, 2013

If temporary border controls continue, the top industries that would be impacted are: Automotive, Chemicals, Electronic and High Tech, and Food products. And the following scenarios can play out:

- Increased border checks mean trucking companies have to compensate drivers for the extra time. Also, this would lead to truckers not meeting KPIs such as "on-time delivery" which would again lead to increase in costs - and this extra costs will have to be borne by shippers.

- Long wait time at borders would lock up available trucking capacity. This may cause temporary imbalance in supply-demand of haul trucks.

- Shippers may prefer alternate mode of transport and may increasingly use Air Cargo to transport certain time-sensitive products.For example, Dover-based Priority Freight reported 900,000 pounds worth of aircraft charters to deliver products in the four weeks after July 23, up from 160,000 pounds in the same period last year, according to Deutsche Welle (http://beroeinc.co/1KNMIyN).

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe