Creating an external benchmark to capture procurement's performance

In my previous blog post, I wrote about how CFO's and CEO's are increasingly expecting procurement (and the overall supply chain organization) to prove that they have put in place an optimal cost structure for their organizations, vis-a-vis the competition. This clearly means that category management will be the need of the hour.

"Benchmarking against Competition" is the polar opposite of Purchase Price Variance (PPV), which basically entails benchmarking against your own performance over the previous year - essentially an internal yardstick.

Internal benchmarks do not provide a clear picture of the actual value of savings. Such benchmarks are akin to the famous parable of the blind men and an elephant, which demonstrate that one's subjective experience, however true it might be, is indeed limited, as it fails to accommodate other necessary truths.

If one was to look at sales, they are broadly measured on two parameters - Revenue and Market Share. The key question procurement needs to ask itself is - "What is the procurement equivalent of market share?"

Of course, external benchmarks are not yet readily available in the market and hence there is an urgent need for formulating them. It is high time to translate words into action and I have strived to come up with the procurement equivalent of "market share" metric.

In that endeavor, let us compare Cost of Goods Sold (COGS) as a percentage of revenue across 7 major pharmaceutical companies. The point to be noted is that each of these companies has said in their annual report that procurement has delivered big savings.

COGS AS PERCENTAGE OF REVENUE

Of course, the companies listed in the above table are not exactly comparable; they are different in size, geographical mix and also each of them operates in different business segments.

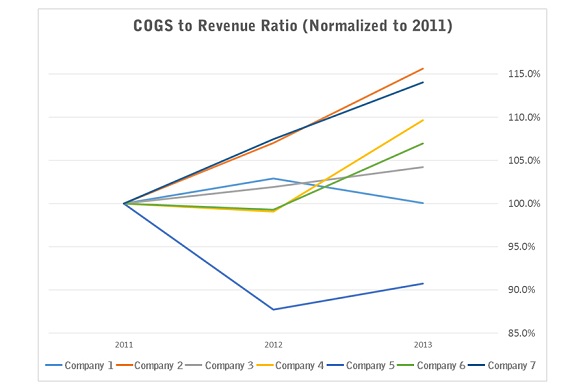

In order to make a meaningful comparison, let us normalize the numbers. Normalization will strip out most of the differences between these companies and will give us the clarity to assess how each company's COGS have performed against revenue.

Let us use the year 2011 as a base and normalize the performance of each company to 100. Once we do this, let us then look at their performance clocked in the years 2012 and 2013 relative to the 2011 base.

The above graph shows that but for one firm, COGS as a percentage of revenue has gone up for all other players. One player has experienced inflation of above 15 percent in their direct costs.

The numbers reveal that despite cost savings generated by procurement, the benefits are not showing up in the bottom line. And why is that? Going forward, procurement managers will have to begin addressing such questions.

From my conversations with CFOs of many large organizations, it is becoming pretty clear that there would be a need to formulate accurate and dependable external benchmarks.

Category management would avoid the pitfall of self-fulfilling prophecies and pave the way for real-time, accurate measurement of procurement performance. And it is imperative to create good external benchmarks to aid procurement managers.

If the captain of a ship is incentivized for course correction i.e., if the ship is completely lost in high seas and the captain is rewarded for steering the ship back to the right path then he would be incentivized to let the ship get lost. But would that be accepted as an ethical maritime practice? No.

Likewise would it be Ok for a company to lose out on the opportunity of performing better than the peers irrespective of the savings shown through the PPV? The answer again is No.

Category management measured by an external benchmark is the right compass for wading through the rough business seas.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe